In August 2024, the IMF published the most recent of its annual reports on the Indonesian economy, under the Article IV Consultation process.

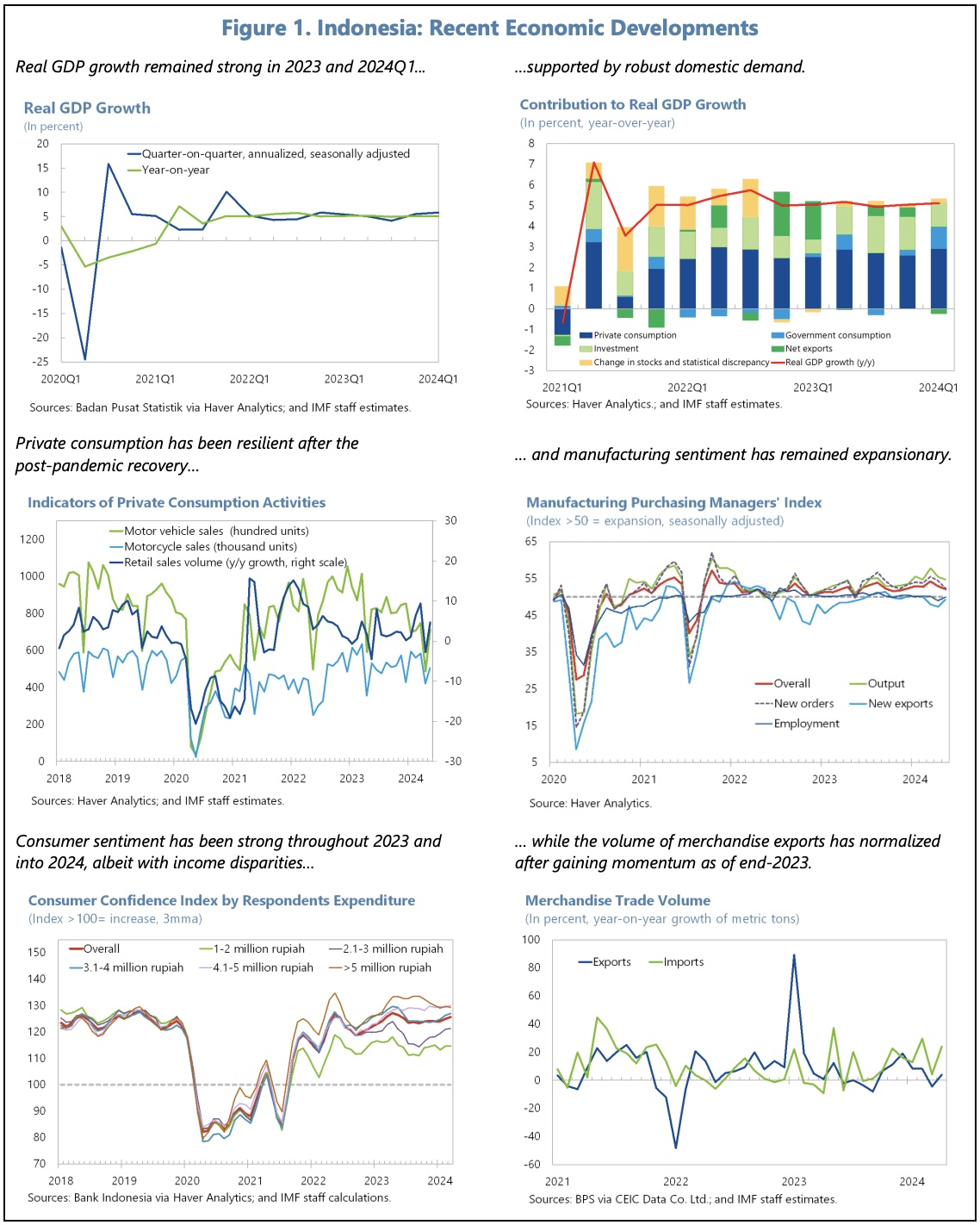

In it, they have welcomed policy frameworks which ‘have provided the foundations for macro-stability and social gains.’ Following a robust recovery after 2020’s shocks, they judge that growth remains strong, inflation is well-contained, the financial sector is resilient, and policies ‘are generally prudent and geared towards preserving buffers.’

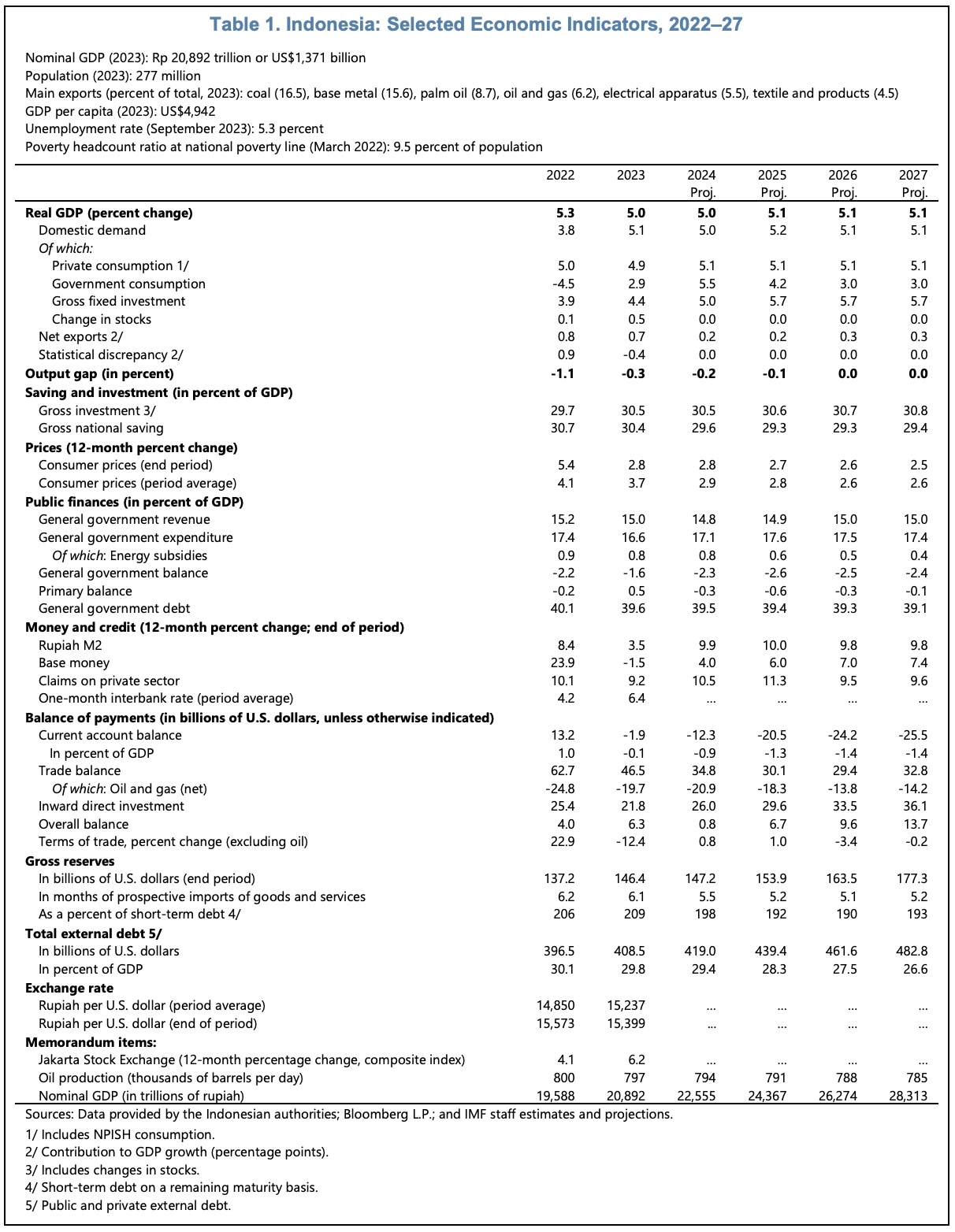

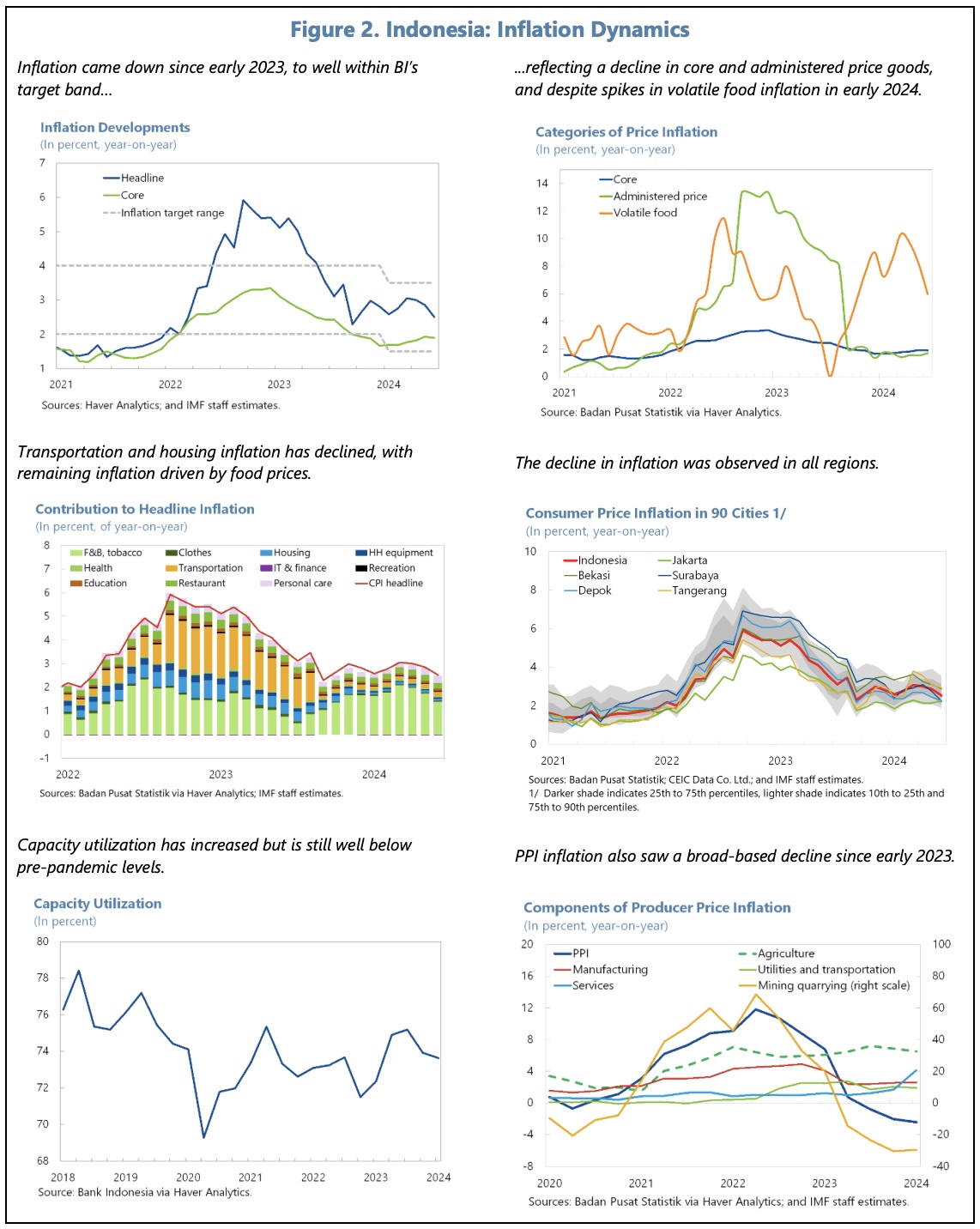

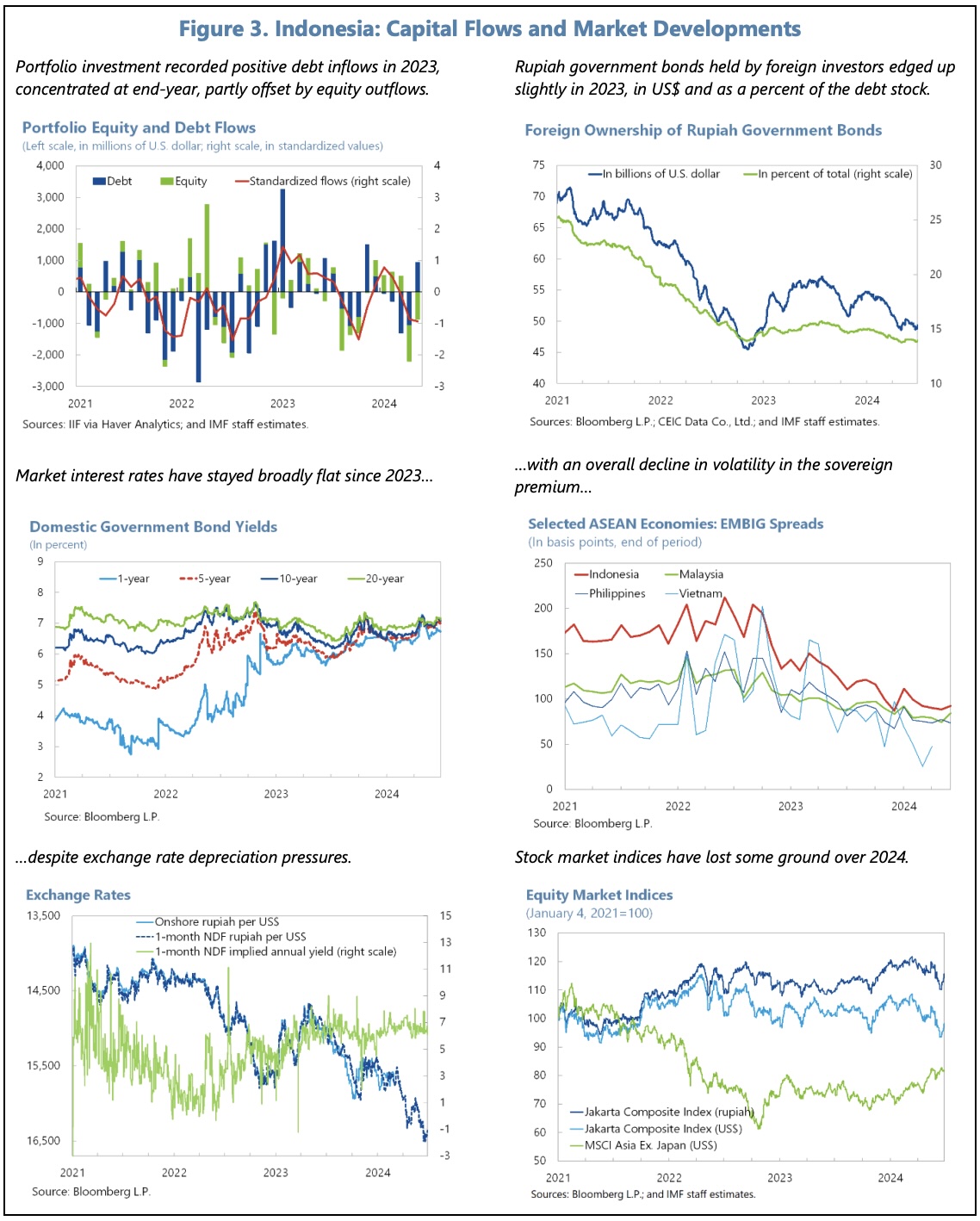

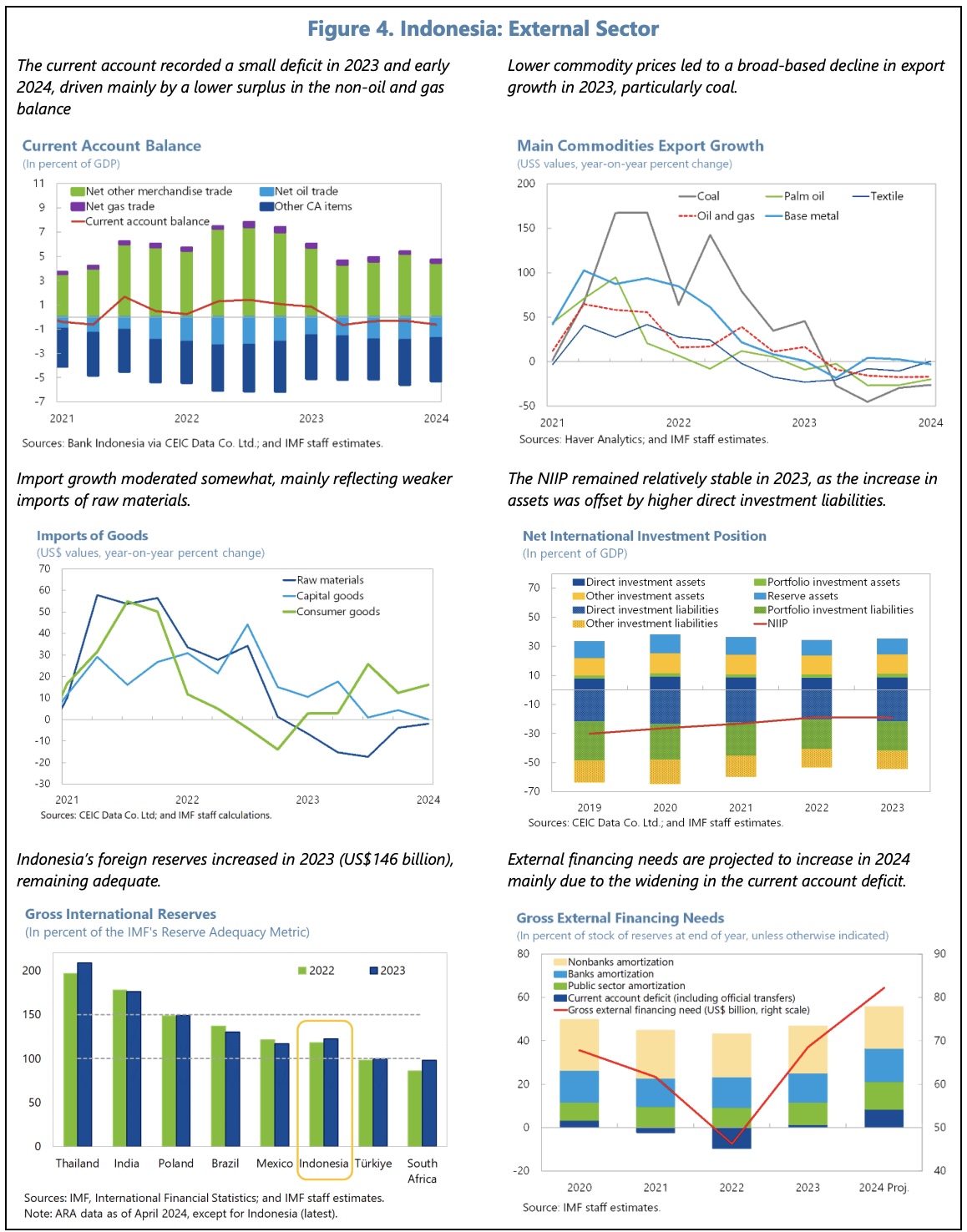

Despite a challenging global context, growth of around 5% is expected in each of 2024 and 2025, as domestic demand offsets the drag from softer commodity prices. Inflation is projected to converge to the mid-point of the target range over time. As import growth is expected to recover faster than exports, the current account deficit is expected to tip into modest deficit. However, FDI and portfolio inflows are expected to support a strengthening in the balance of payments surplus and an increase in reserve buffers.

Risks are seen as broadly balanced. Alongside external risks, the IMF has mentioned the need to avoid a weakening of long-standing sound macro-fiscal frameworks, which could hamper policy credibility. On the other hand, deeper-than-envisaged structural reforms could raise growth over the medium term.

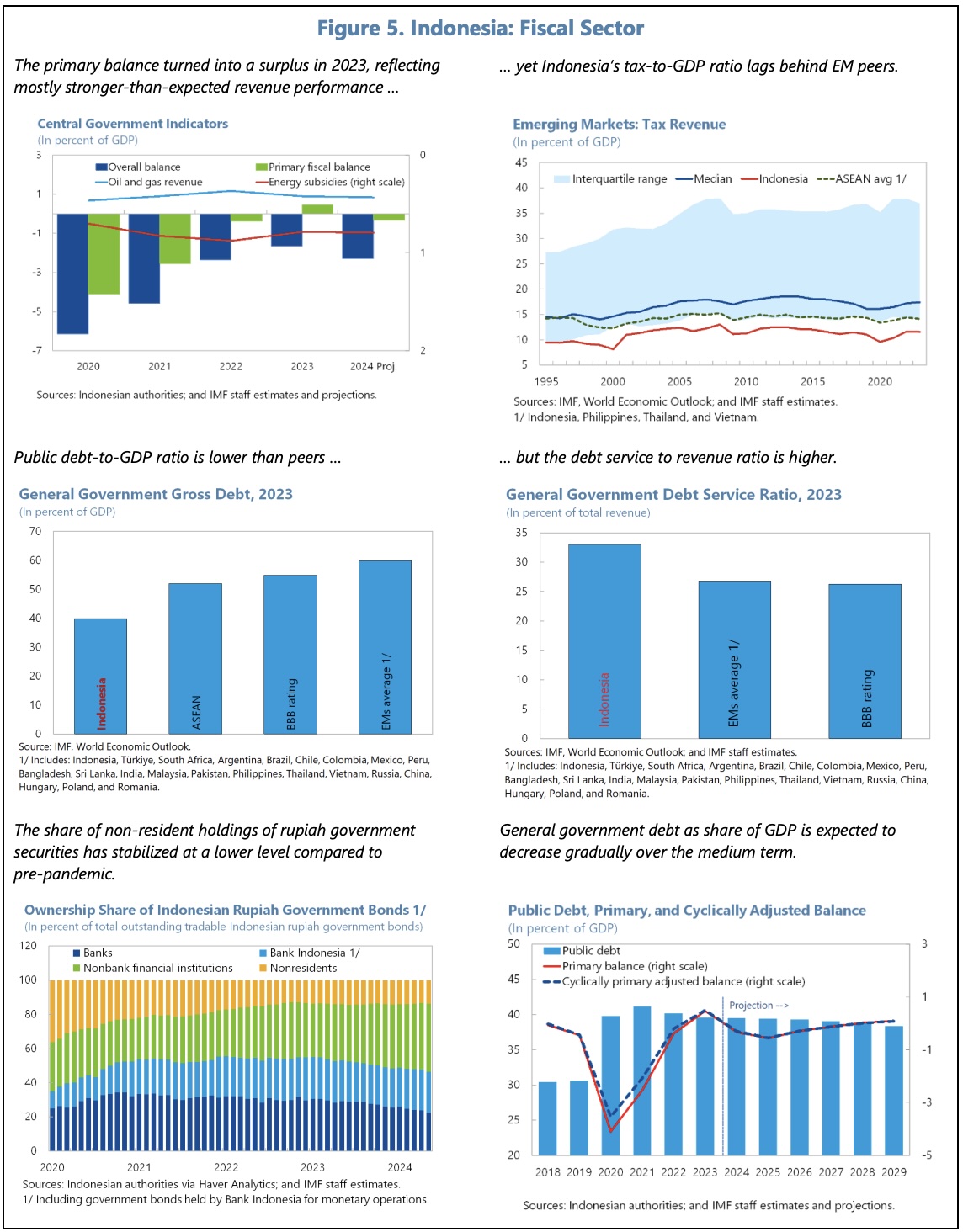

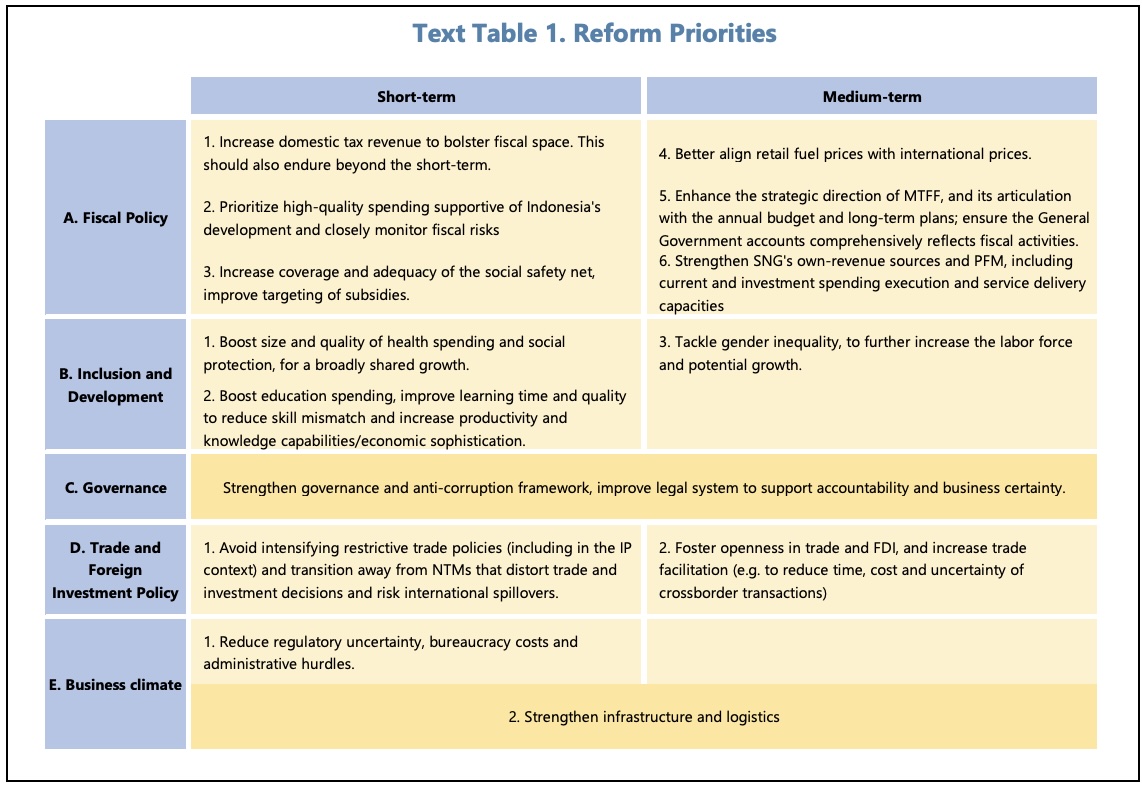

In their remarks, the Directors considered that slightly narrower fiscal deficits in 2024 and 2025 would support growth while preserving space to respond to downside risks. They see scope to allow more countercyclical policies within the budget cap, and supported efforts to strengthen revenue mobilization and streamline energy subsidies to create room for development spending.

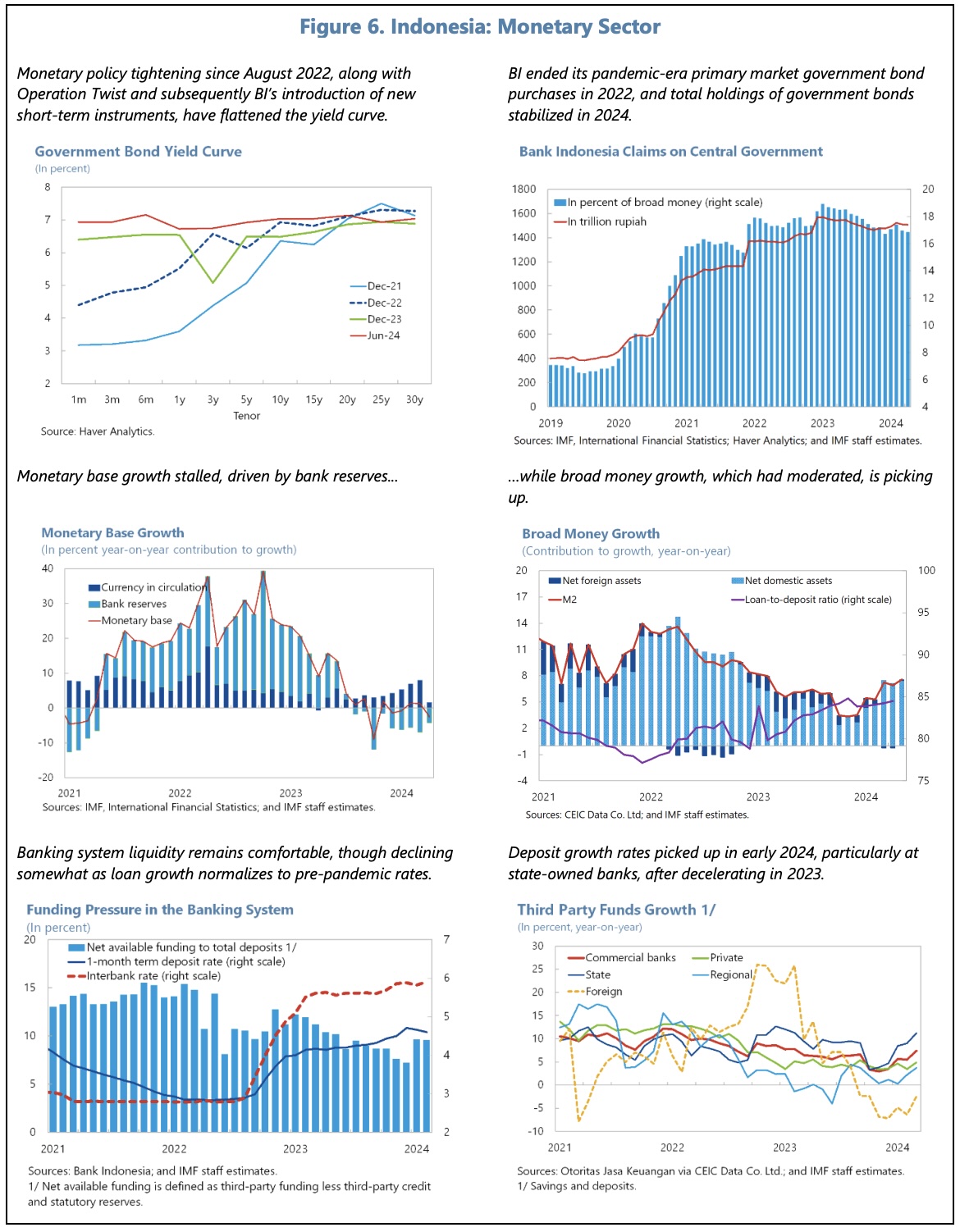

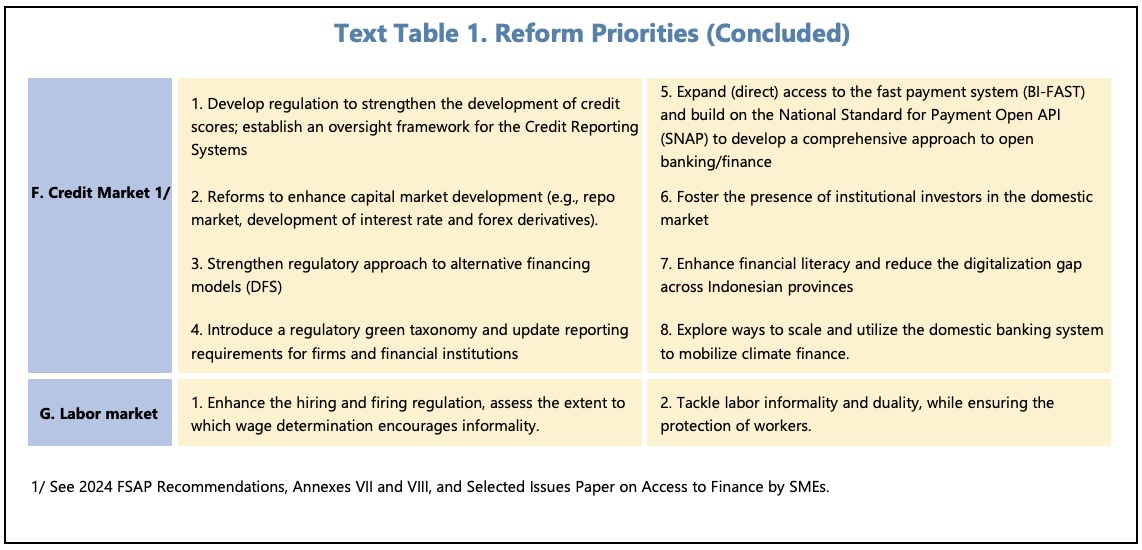

They welcomed the reduction of inflation to the target range and agreed that the monetary policy stance should remain data dependent, supported by an approach to exchange rate flexibility which also preserves reserve buffers. They supported efforts to deepen financial markets and strengthen the effectiveness of monetary policy transmission.

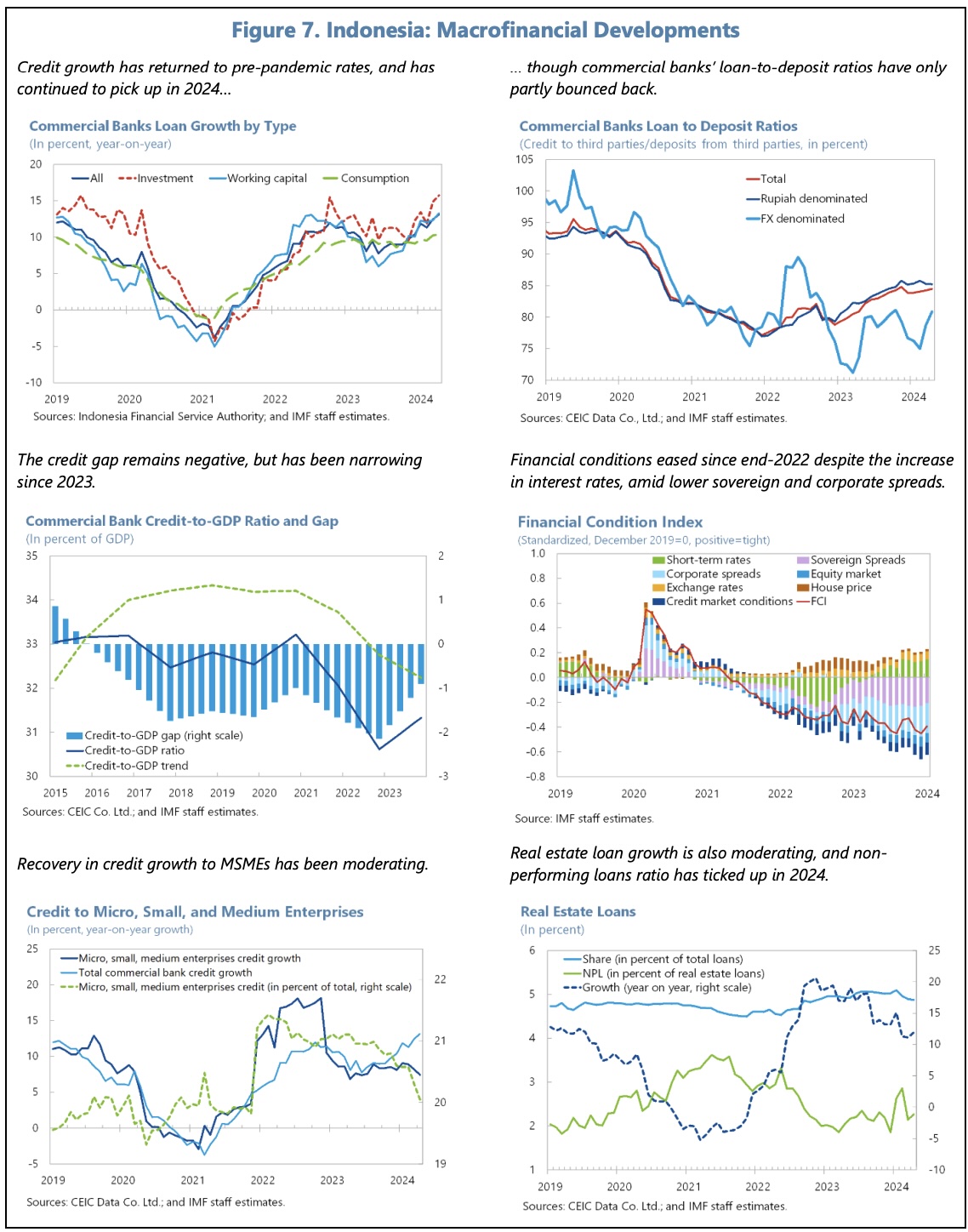

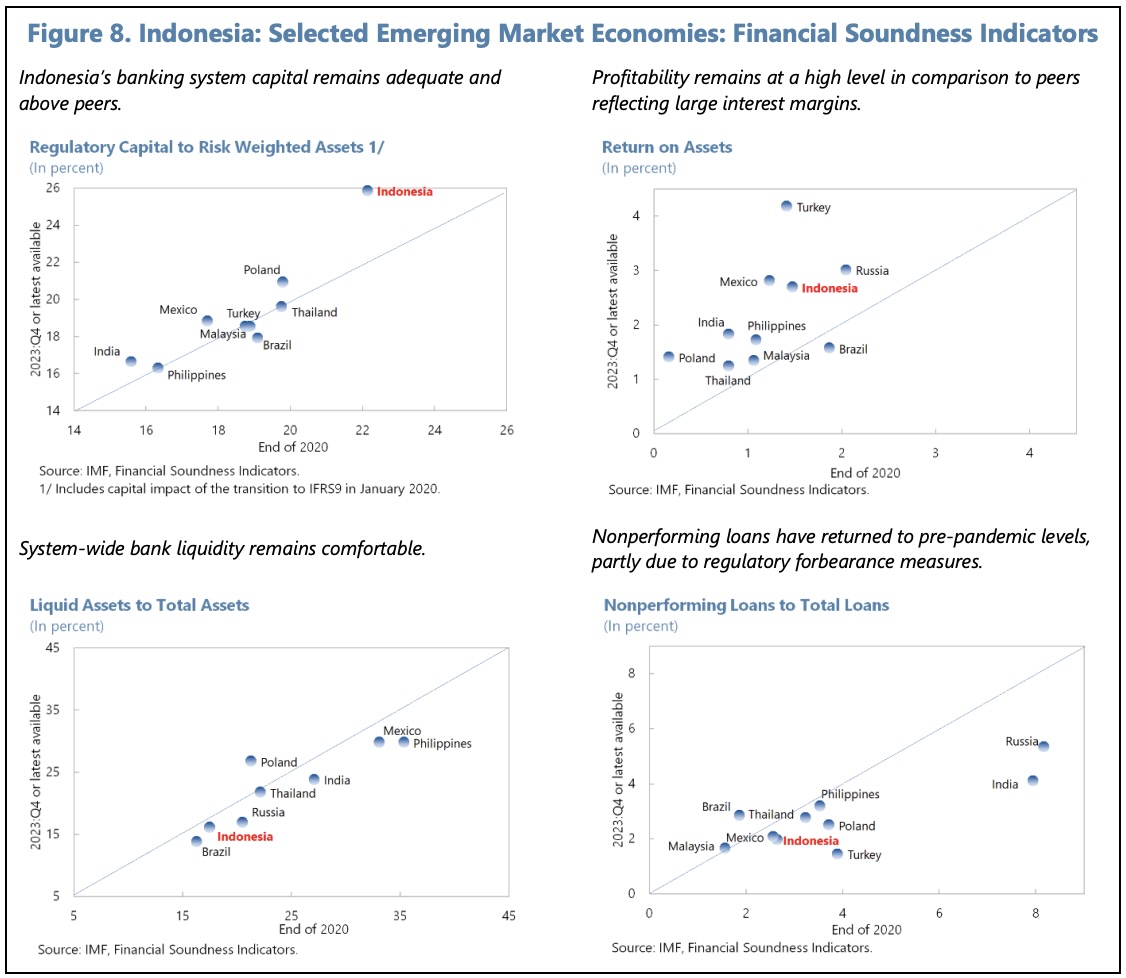

The financial system is broadly resilient and well-capitalized. However, the Directors support further strengthening of financial sector supervisory and regulatory frameworks, the financial safety net, crisis management, and the close monitoring of pockets of vulnerability.

They welcomed efforts to enhance the macroprudential policy framework and saw merit in clarifying the primacy of financial system resilience. They encouraged a gradual tightening of the macroprudential stance as the credit gap closes. Further strengthening the AML/CFT framework remains important.

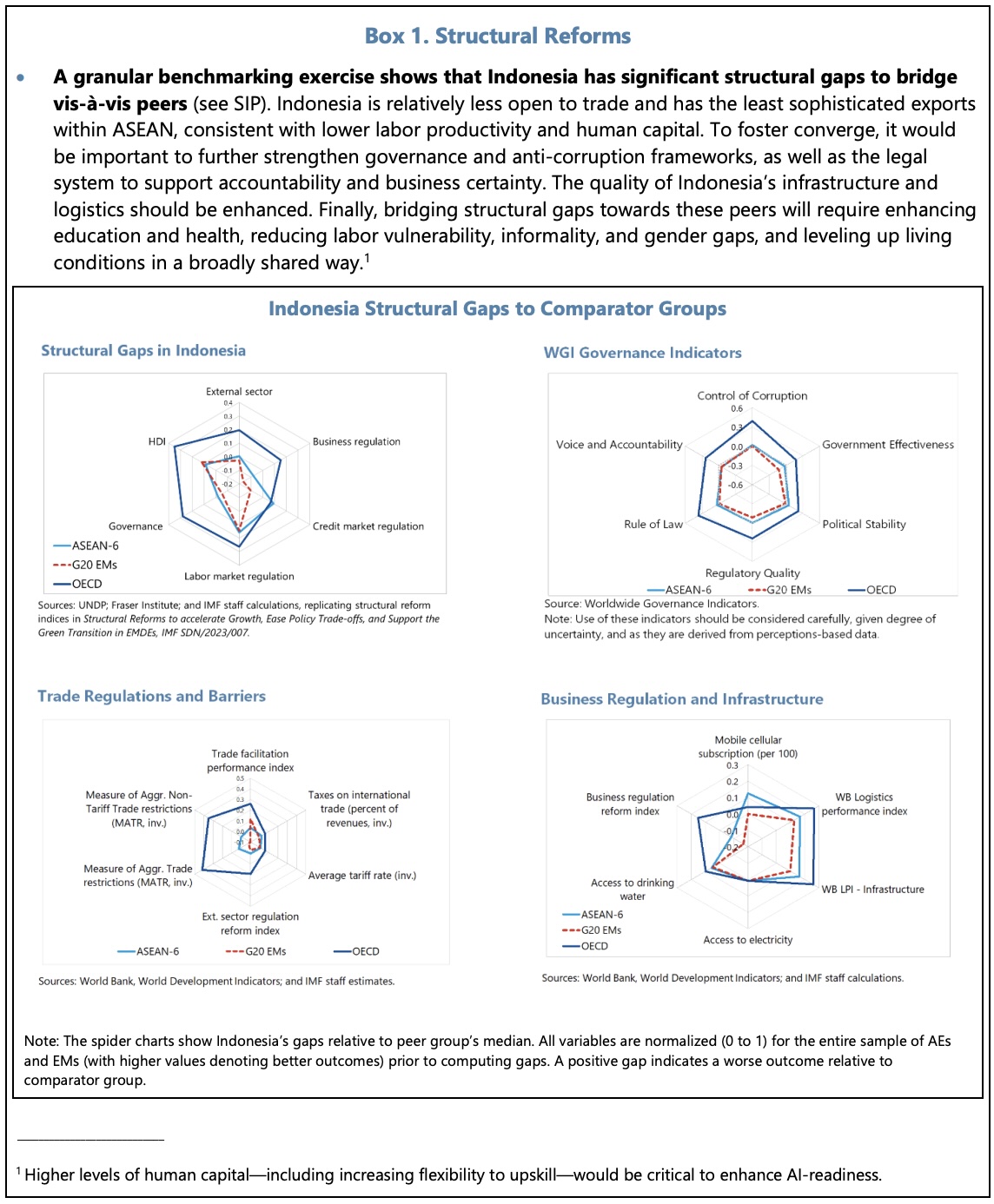

The Directors welcomed the authorities’ goal of reaching high-income status by 2045, though they noted that this will require ambitious structural reforms, including on governance and anti-corruption, levelling up learning outcomes, logistics and infrastructure, fostering trade openness, and enhancing social protection.

Finally, they welcomed the authorities’ commitments to achieve net-zero emissions by 2060. In their opinion, alongside the steps to limit greenhouse gas emissions and deforestation, a plan for off-grid power generation energy subsidy reforms and carbon pricing, and the phasing out related non-tariff measures are key to a successful outcome.

The following tables and charts should help to summarise the IMF’s assessment of the economy and its outlook.

To read the full Article IV report, please use the following link to the IMF’s website: