The World Bank have published their most recent Development Update on Sri Lanka. In it, they explain the causes of the current economic crisis and provide an update on economic performance, before outlining priorities looking forward.

Without going into the details of the important welfare impacts of the crisis, which the World Bank have also assessed in the report, this note seeks to summarise the World Bank’s assessment of the economic situation.

Recent Economic Developments

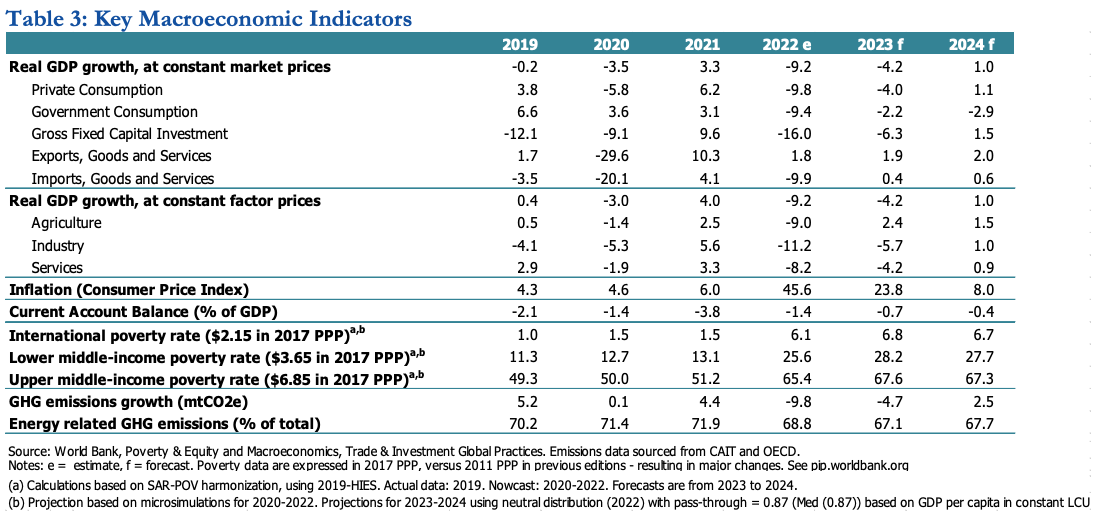

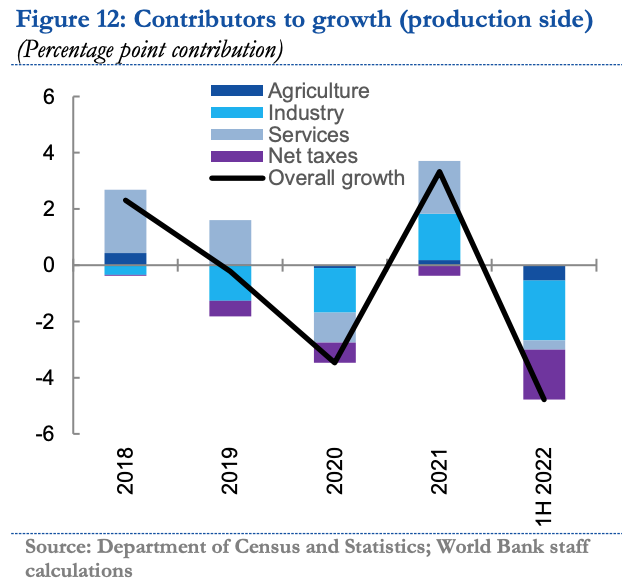

In H1 2022, real GDP contracted by 4.8% YoY. Agriculture and industry were weak, as a result of supply chain disruptions and a shortage of inputs, whilst services, which were supported by a gradual recovery in tourism, contracted more modestly. The ban on agrochemicals, although it was removed in November, is expected to produce a significant short-term drop in yields and to impact severely the incomes of over a million small farmers. Due to FX shortages, fertiliser remains in scarce supply.

Leading indicators for Q2 such as electricity sales (-9.2% YoY), cement consumption (-40% YoY), and the purchasing managers’ surveys suggest there is a significant deterioration in activity underway. Exports, supported by textiles, are performing better.

Inflation, as measured by the Colombo CPI, rose by 64% YoY in August. High commodity prices, the fertiliser ban, partial monetisation of the fiscal deficit and currency depreciation have all played their part.

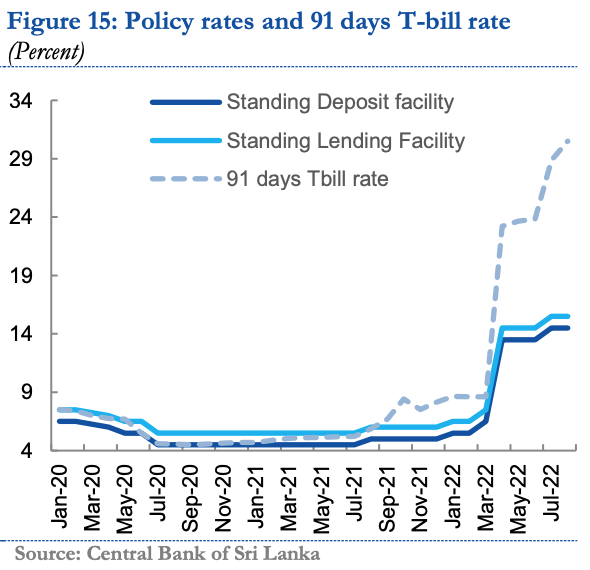

Interest rates have risen sharply, including a 700 basis point rise in the policy rate in April 2022. As real rates remain negative, however, further tightening in policy is warranted, according to the World Bank, which noted that 91D T-Bills were auctioned at over 30% in the primary market in August.

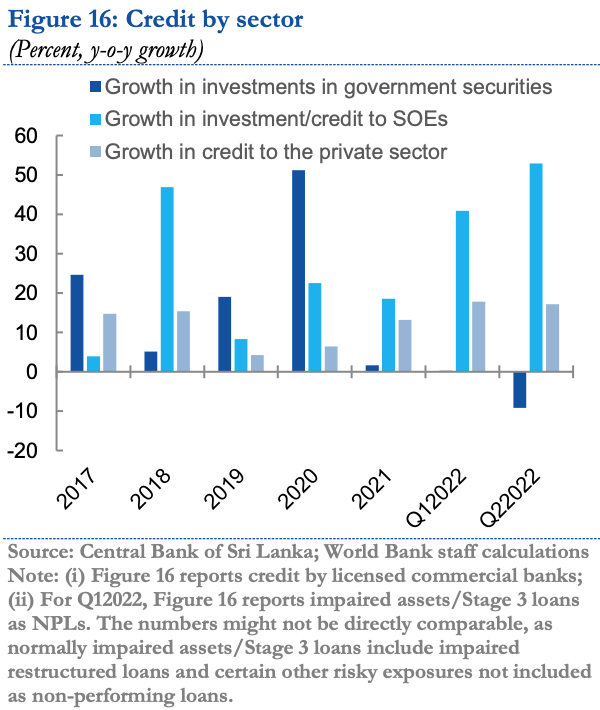

Financial sector stability is being severely tested. Banks’ lending to the government slowed significantly in 2021, but they are significantly exposed to distressed SOEs, and have losses on their exposure to both (33% of total assets) as yet unrecognised. There is also an acute shortage of foreign exchange.

In Q1, the banks’ reported NPL ratio was 8.4% and their reported capital adequacy ratio was 15.1%. However, these do not reflect COVID-related forbearance measures or unaccounted losses on SOE and sovereign portfolios.

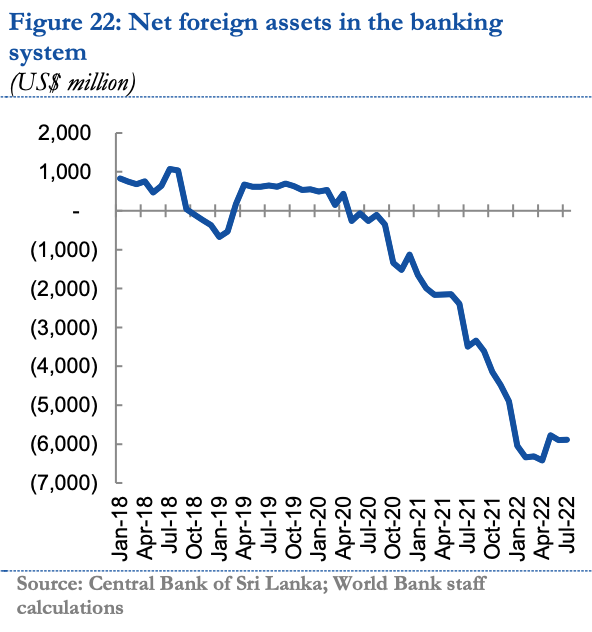

Despite a narrowing in the trade deficit in H1 2022, the current account is expected to have widened, with a decline in remittances more than offsetting a rise in tourism receipts. The current account deficit may decline over the balance of the year, as imports fell by 25% YoY in June and July. Nonetheless, a loss of market confidence has made it difficult to bring back export earnings and remittances to Sri Lanka, despite FX controls and mandatory repatriation and conversion rules which have imposed by the central bank.

In June 2022, net foreign assets in the banking system stood at USD -5.9bn. The impact of the foreign exchange liquidity crisis is being felt across the economy, with sporadic shortages of fuel and energy, milk powder, wheat flour, intermediate goods used by industry, and even of imported medicines.

The government suspended external debt service payments in April 2022. The incumbent president resigned on July 9th.

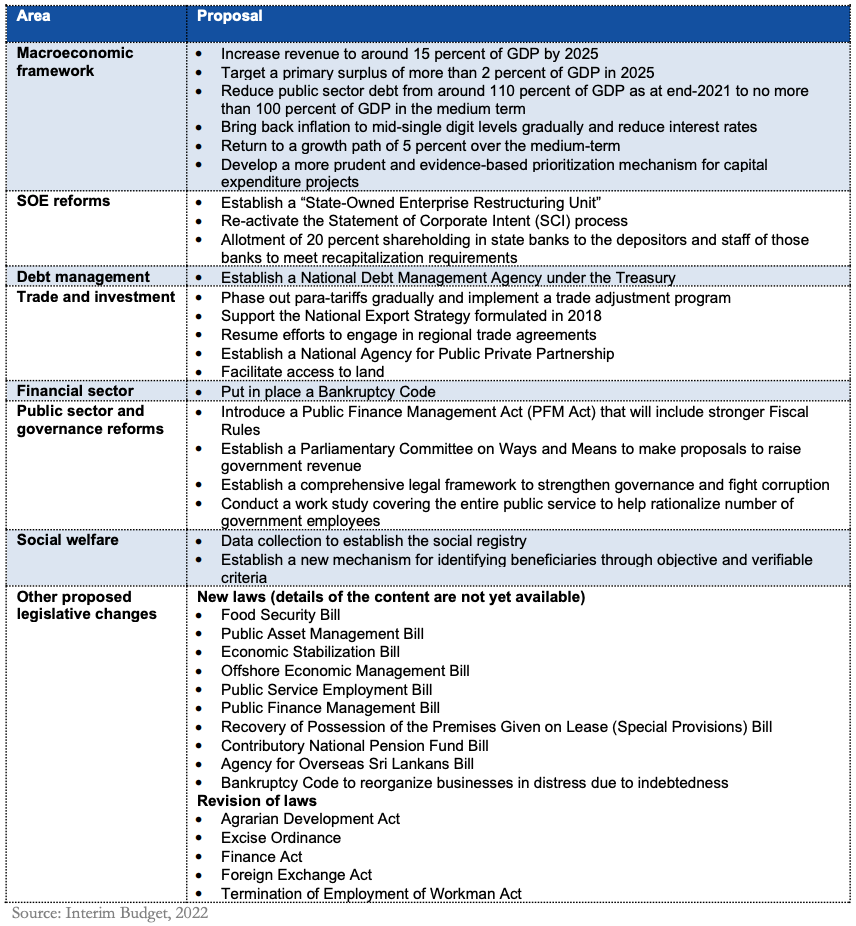

At the end of May, the new administration announced several revenue mobilisation measures to reduce the fiscal deficit. These included rises in the personal and corporate tax rates, and a reduction in allowances, and an increase in the standard VAT rate from 8% to 12%.

In September, Sri Lanka reached a Staff Level Agreement with the IMF for a 40-month Extended Fund Facility program of USD 2.9bn. This is subject to IMF board approval.

According to the IMF’s statement, the agreement is “contingent on the implementation by the authorities of prior actions, and on receiving financing assurances from Sri Lanka’s official creditors and making a good faith effort to reach a collaborative agreement with private creditors. Debt relief from Sri Lanka’s creditors and additional financing from multilateral partners will be required to help ensure debt sustainability and close financing gaps”.

The key elements of the programme involve:

- Raising fiscal revenue through tax reforms, targeting a primary surplus of 2.3% GDP by 2025

- Introducing cost-recovery pricing for fuel and electricity to minimise fiscal risks from SOEs

- Raising social spending

- Restoring price stability through data-driven monetary policy, fiscal consolidation, phasing out monetary financing, and stronger central bank autonomy

- Rebuilding foreign reserves through restoring a market-determined and flexible exchange rate

- Ensuring a healthy and adequately capitalised banking system; upgrading financial sector safety nets and regulatory standards with a revised Banking Act

- Reducing corruption vulnerabilities

The following is a link to the IMF’s press release announcing the staff level agreement: