In December, the IMF published their findings on the Indian economy following their most recent Article IV consultations. This note summarises their key conclusions.

Summary

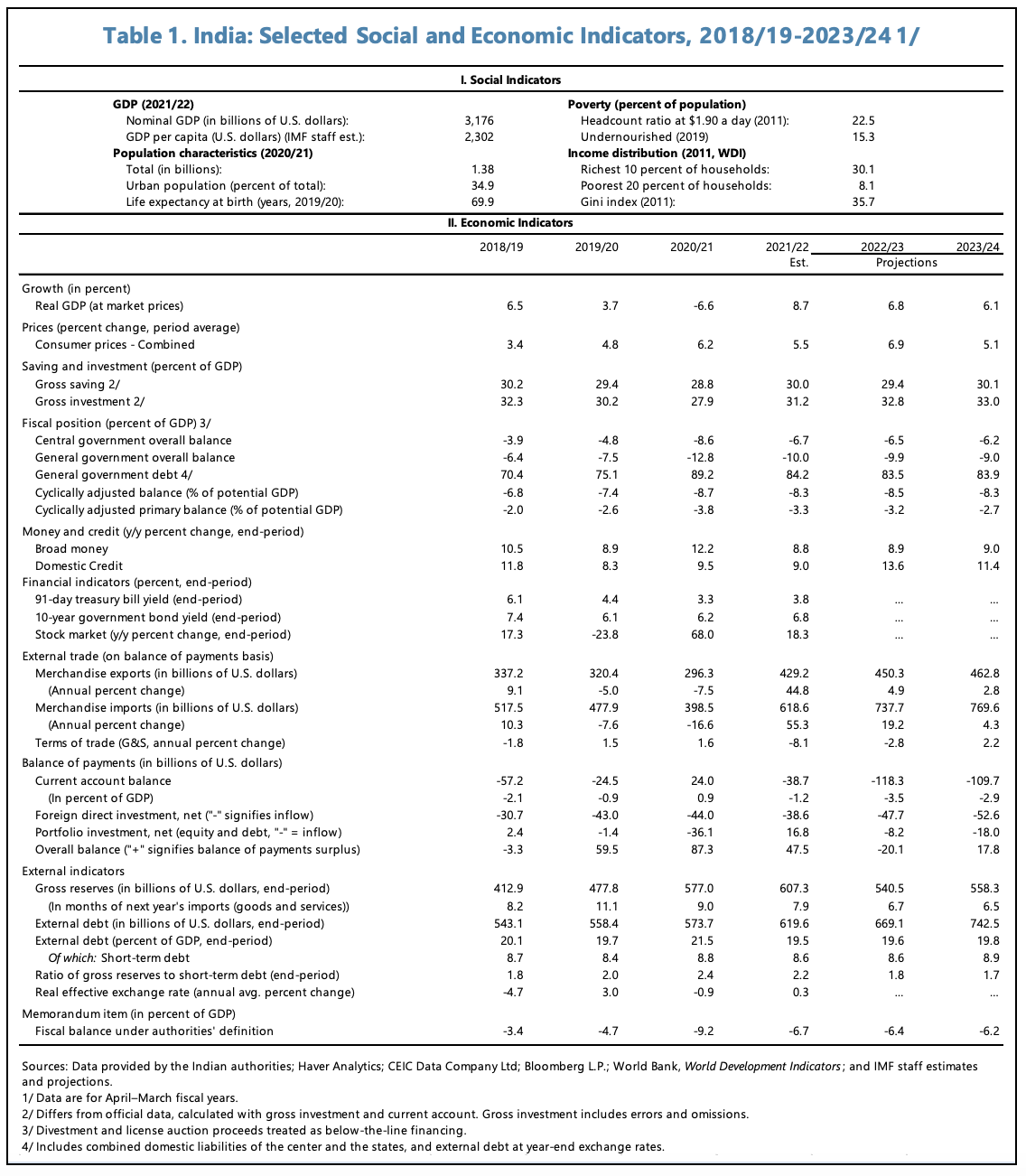

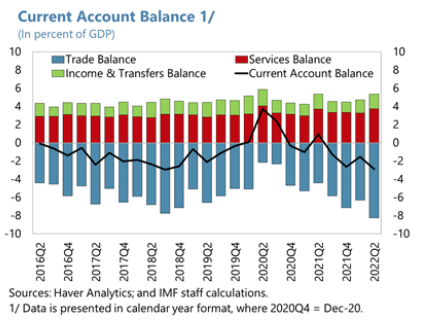

The Indian economy has rebounded from the pandemic, with real GDP rising by 8.7% YoY in FY2021/22. Output has returned to pre-pandemic levels. The IMF projects growth of 6.8% YoY in FY2022/23 and 6.1% YoY in FY2023/24. Consumer prices are projected to rise by 6.9% YoY on average in FY2022/23, and by 5.1% YoY in FY2023/24. The current account deficit is expected to rise to 3.5% GDP in FY2022/23, as a result of higher commodity prices and strengthening imports.

The following is a summary of the IMF’s economic forecasts, the risks of which, they say, are tilted to the downside:

The IMF has commended India on the measures taken to respond to the COVID pandemic, in particular fiscal measures to protect vulnerable groups and monetary policy tightening to address inflation.

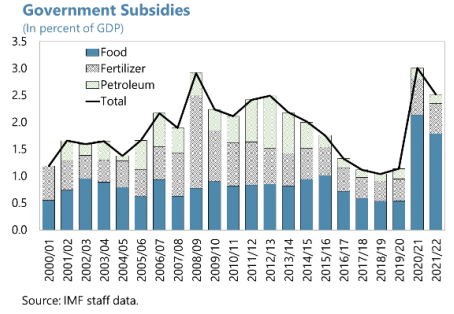

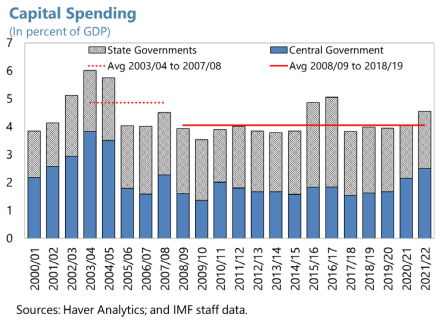

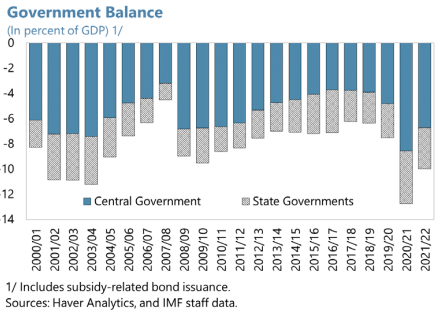

They commented that, whilst public debt sustainability risks have increased, they are mitigated by debt characteristics. Nevertheless, they recommend a more ambitious, well-communicated medium-term fiscal consolidation, anchored on stronger revenue mobilisation and improved expenditure efficiency, which leaves high-quality spending on infrastructure, education and health protected.

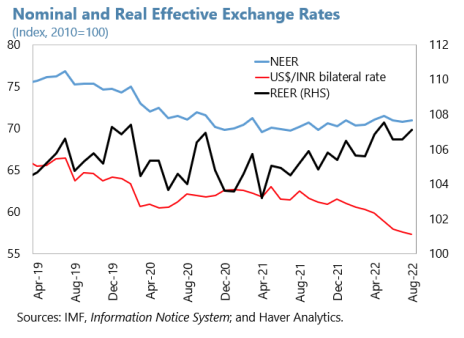

They recommend that additional monetary policy tightening should be carefully calibrated to balance inflationary objectives and their impact on activity. As India’s external position is broadly in balance, they recommend that the exchange rate should continue to act as a shock absorber, and that foreign exchange intervention should be limited.

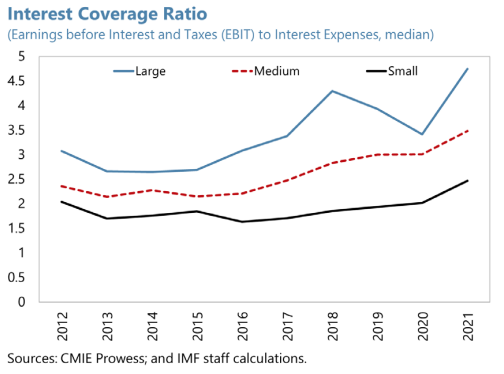

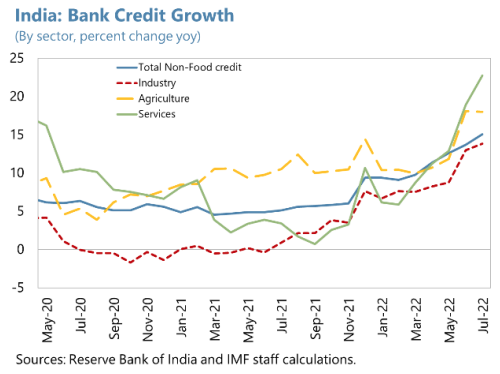

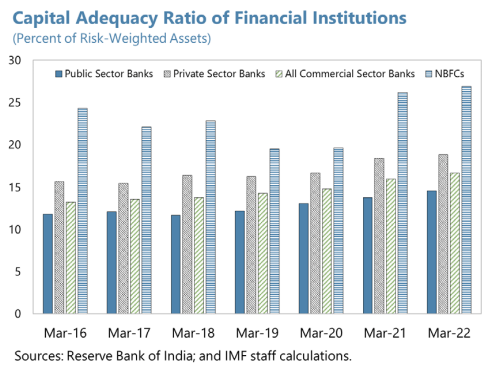

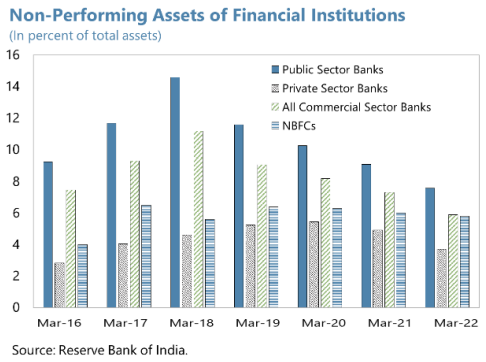

Corporate and financial sector balance sheets have improved. Nonetheless, in an environment of tightening financial conditions, they suggest the banks should be encouraged to build additional capital buffers and to recognise problem loans, and that targeted prudential rules and further reforms should be used to strengthen the system’s resilience.

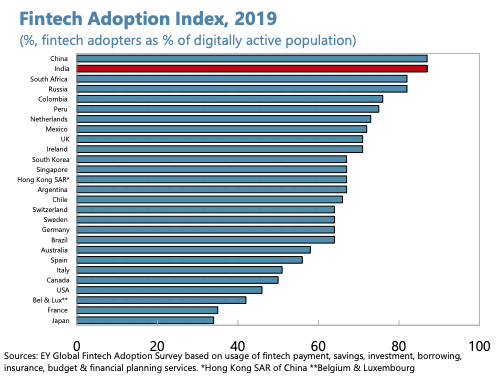

The IMF have praised India’s achievements in digitalisation, which has done much to modernise the public sector, to improve tax compliance, to streamline the provision of government benefits and services, and to provide a platform for innovation. Digitalisation has also done much to increase financial inclusion.

They see scope for further productivity gains if the digital divide is further reduced through improved access and literacy. Although India hosts 1.15 bn mobile subscriptions, and 98% of the population has access to at least a 4G network, 57% of Indians are not internet users, and non-users are disproportionately female, live in rural areas, and in less wealthy states.

In the arena of structural reforms, the IMF have suggested measures to increase female labour force participation and reduce youth unemployment. They comment that strengthening governance and the regulatory framework would foster transparency and public accountability. They believe reductions in tariffs would help deepen India’s integration in global value trains.

Economic Overview

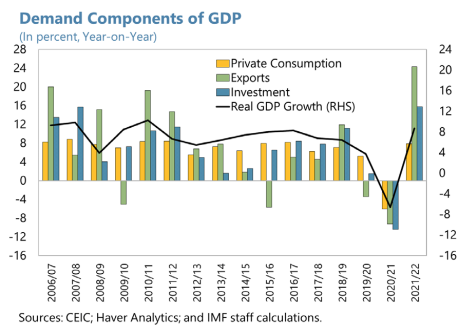

Real GDP growth has recovered strongly from the pandemic, led by private consumption, investment and exports.

The current account has returned to deficit, as a result of domestic demand recovery and surging oil import costs.

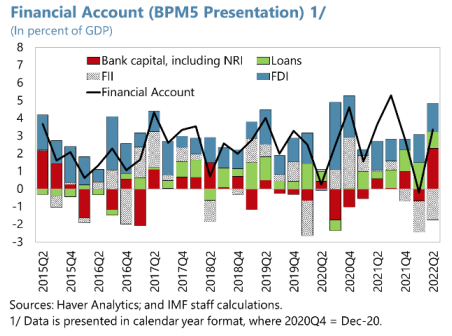

Nonetheless, steady foreign direct investment and debt inflows have supported financial account surpluses, even though external shocks have triggered large portfolio investment outflows.

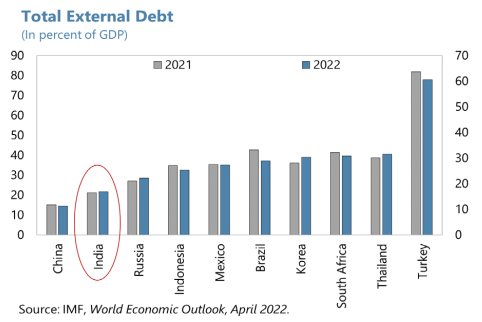

A low level of external debt, as well as adequate FX reserves, serve to mitigate external vulnerabilities.

The rupee has come under depreciation pressure, albeit to a lesser degree than some other EM currencies. The real effective exchange rate has moved in a tight range since 2019. Looking forward, the IMF believe a flexible exchange rate should continue to act as the first line of defence in absorbing external shocks.

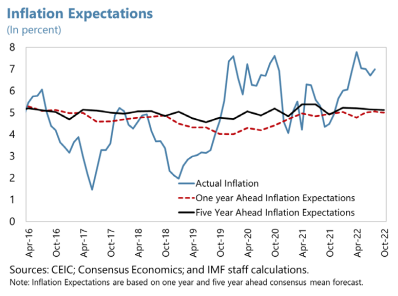

Inflation has risen in line with G-20 peers and has remained above the RBI’s upper band of 4% +/- 2%. Core inflation is “sticky”. In September, headline CPI rose by 7.4% YoY, and core inflation, excluding food and fuel, was 6%. Inflation expectations, however, remain relatively well-anchored.

Monetary policy has been tightened through higher policy rates and liquidity absorption, and there has been some early reversal in pandemic-related easing.

Fiscal Policy

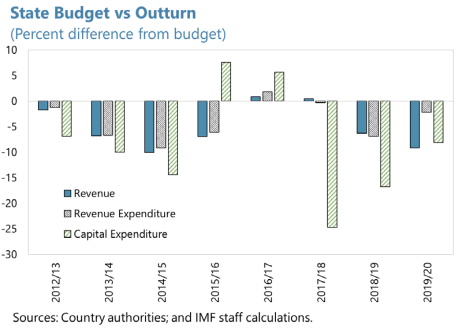

The fiscal deficit narrowed in FY2021/22, as pandemic-related measures were phased out and revenues recovered. Although there are significant variations in debt burdens at the state level, in aggregate their deficit has declined to close to the medium-term target of 3% GDP.

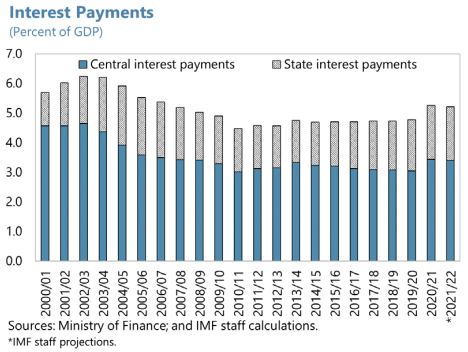

India has reaffirmed its 4.5% GDP central government deficit target by FY2025/26. This implies a general deficit of 7.5% GDP. However, with debt/GDP at 84%, and gross financing needs of 15% GDP, debt sustainability risks have increased.