In June 2024, the IMF completed its 2024 Article IV Consultation and Second Review under the 48-month Extended Fund Facility with Sri Lanka. It has granted immediate access to Statutory Drawing Rights of 254mn ($336mn) to support Sri Lanka’s economic policies and reforms.

The IMF reports that performance under the program has been strong. All quantitative targets for end 2023 were met, except the indicative target on social spending. Most structural benchmarks due by end-April 2024 were either met or implemented with delay.

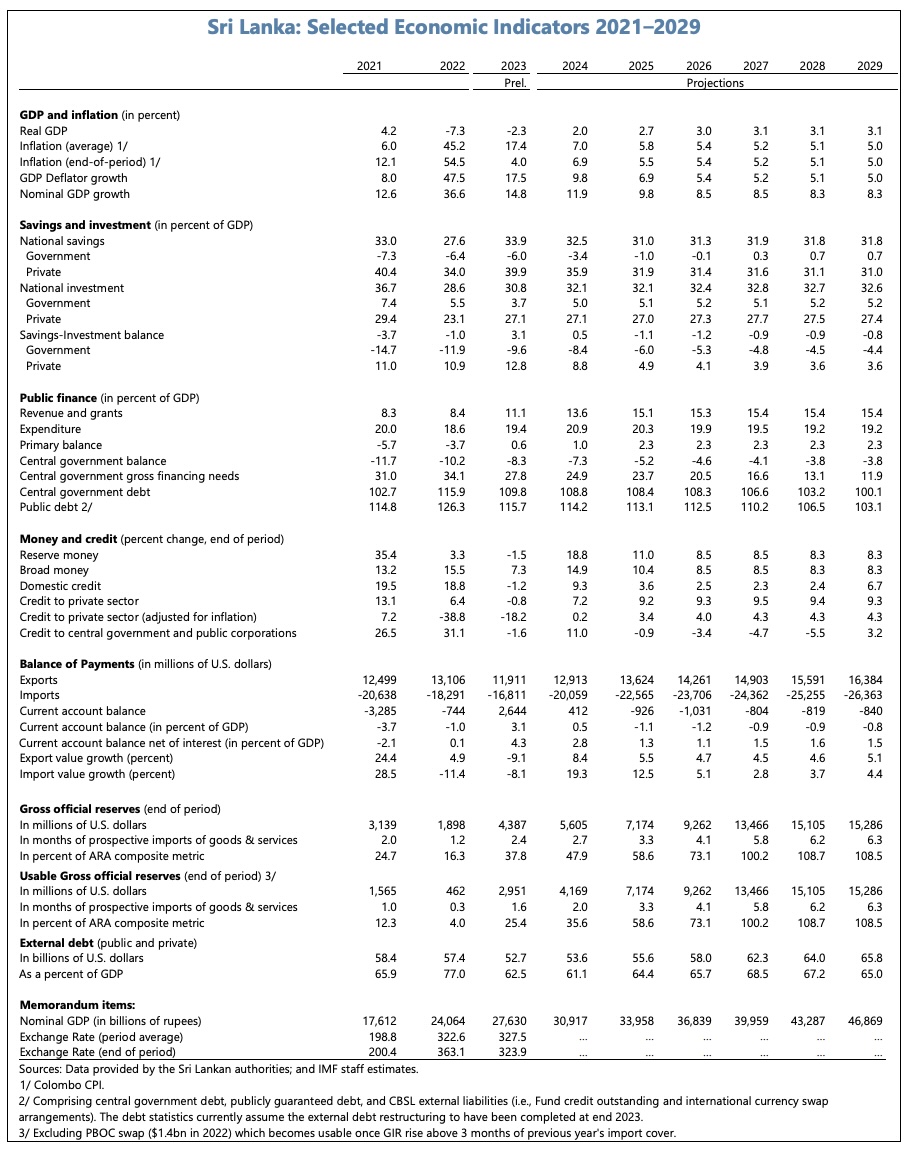

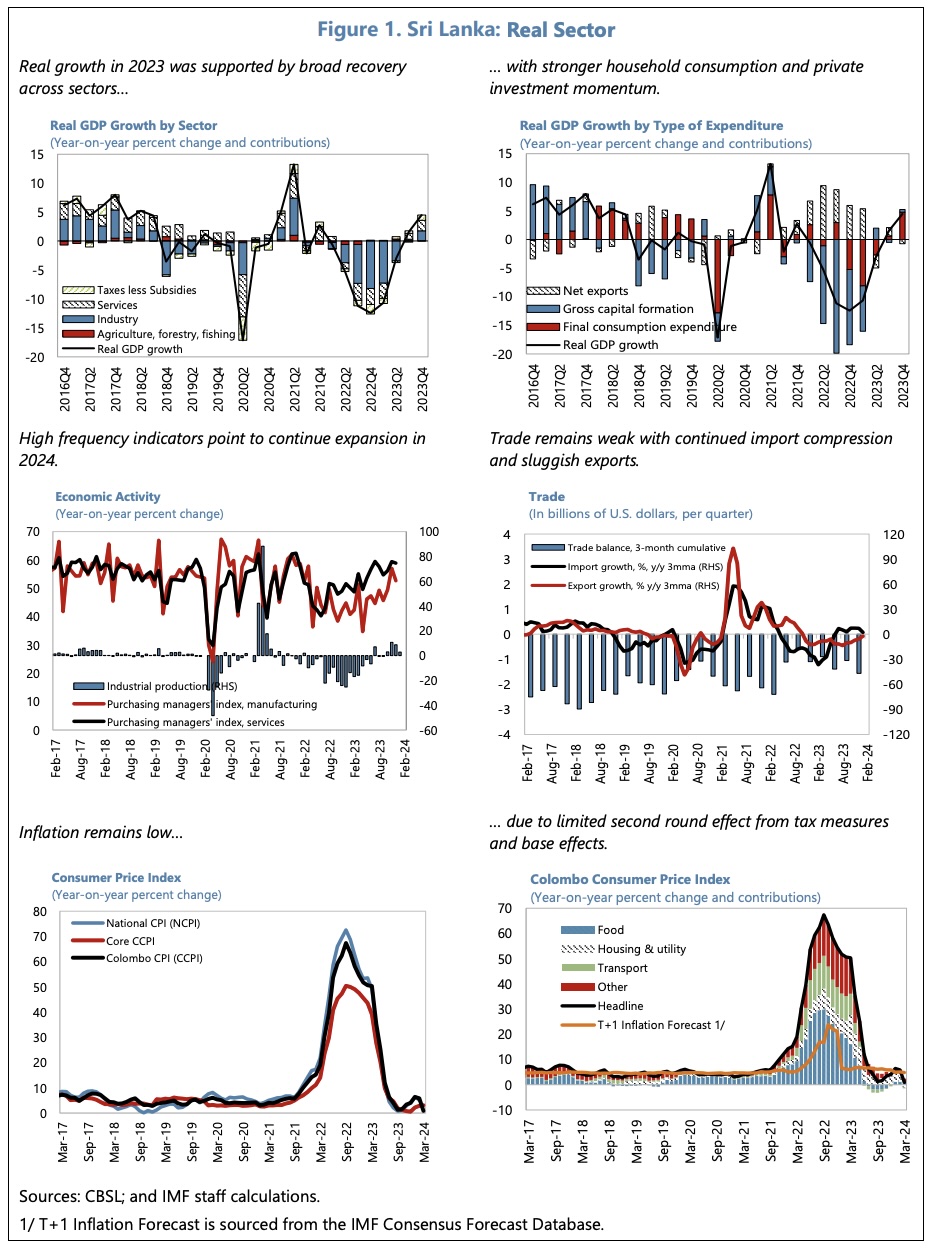

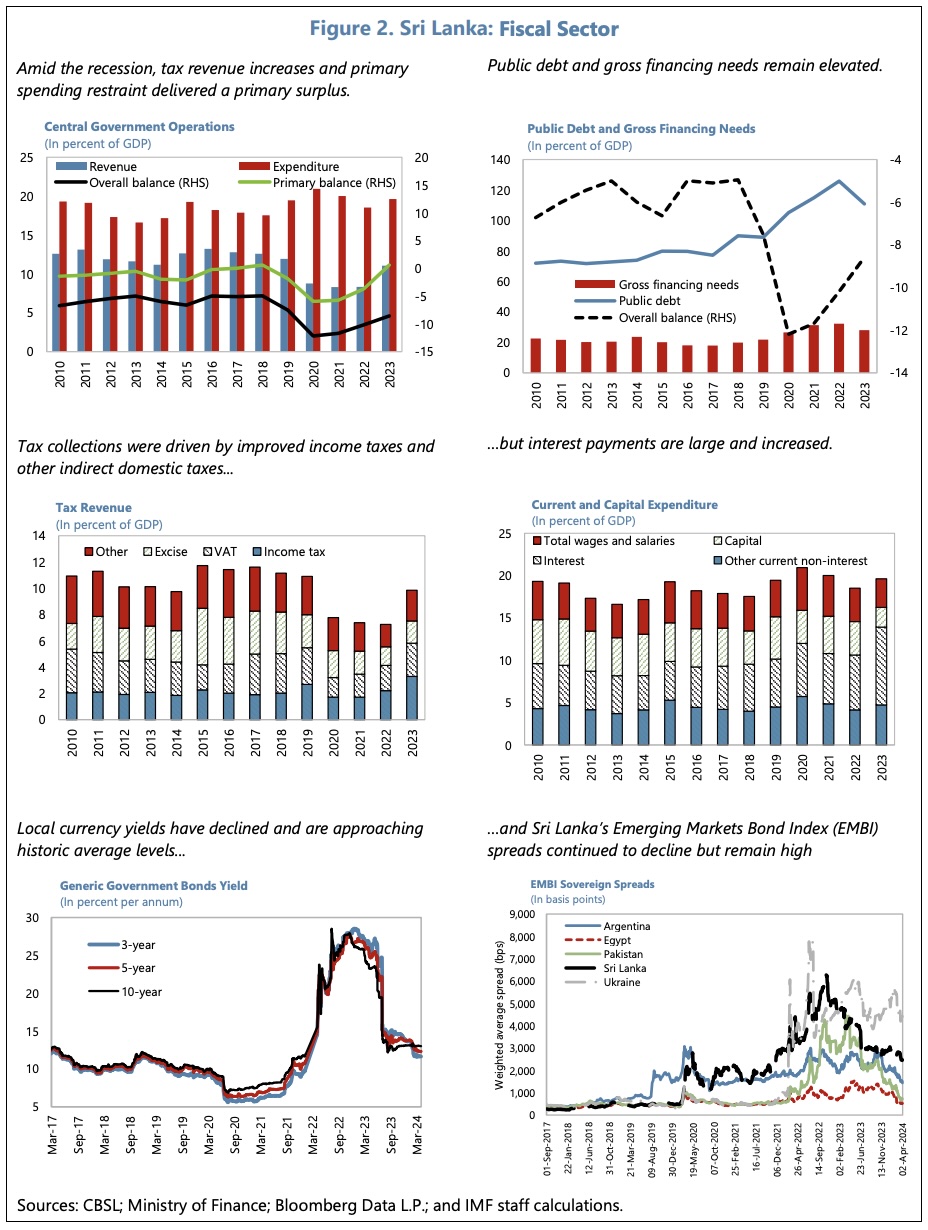

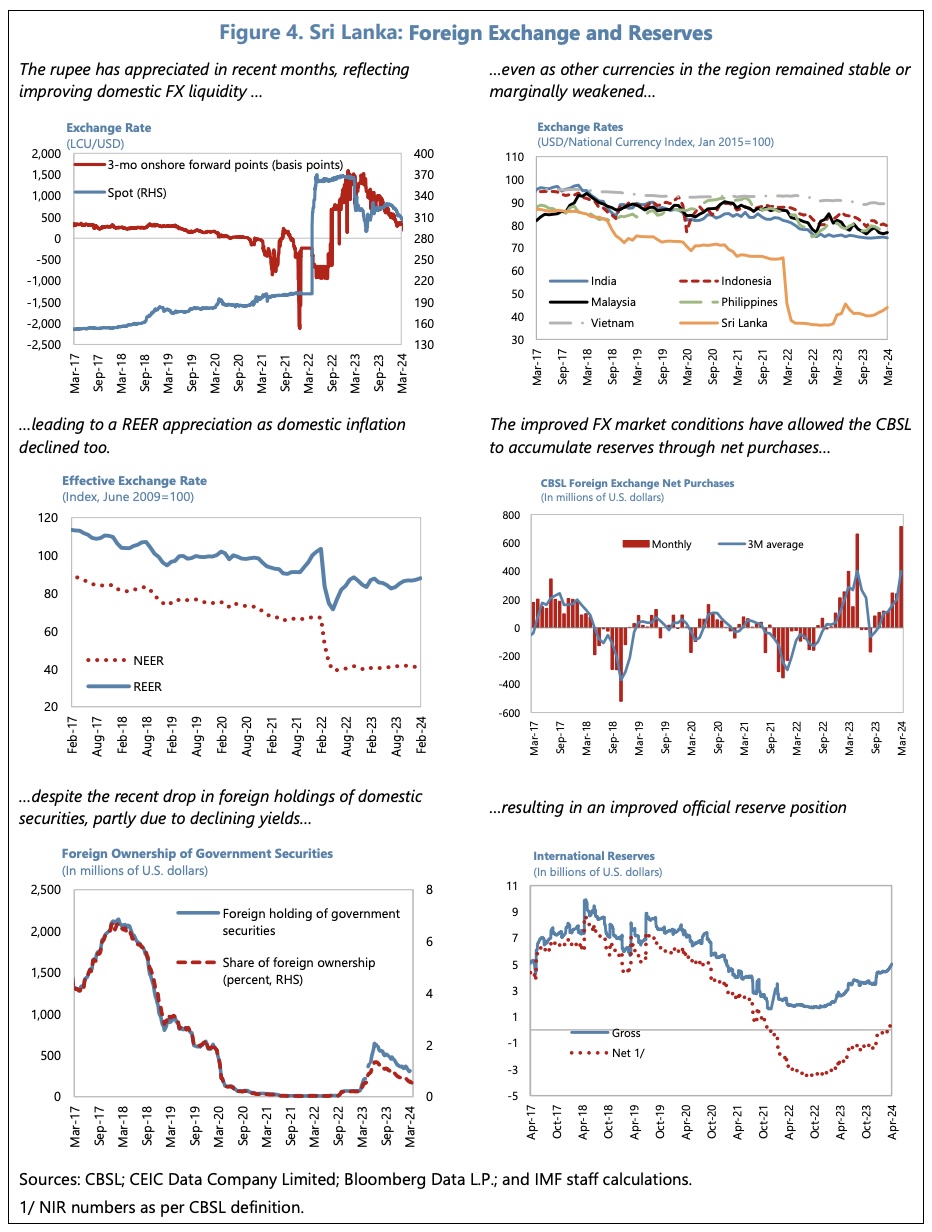

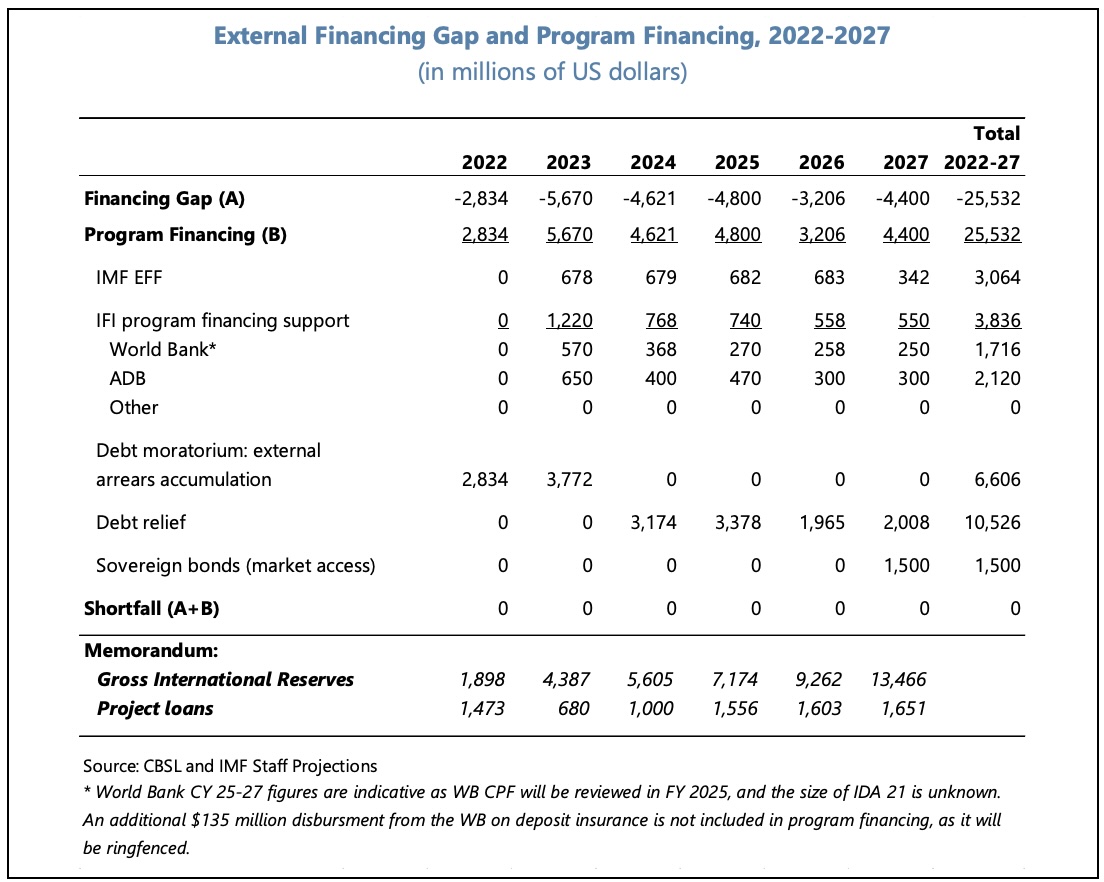

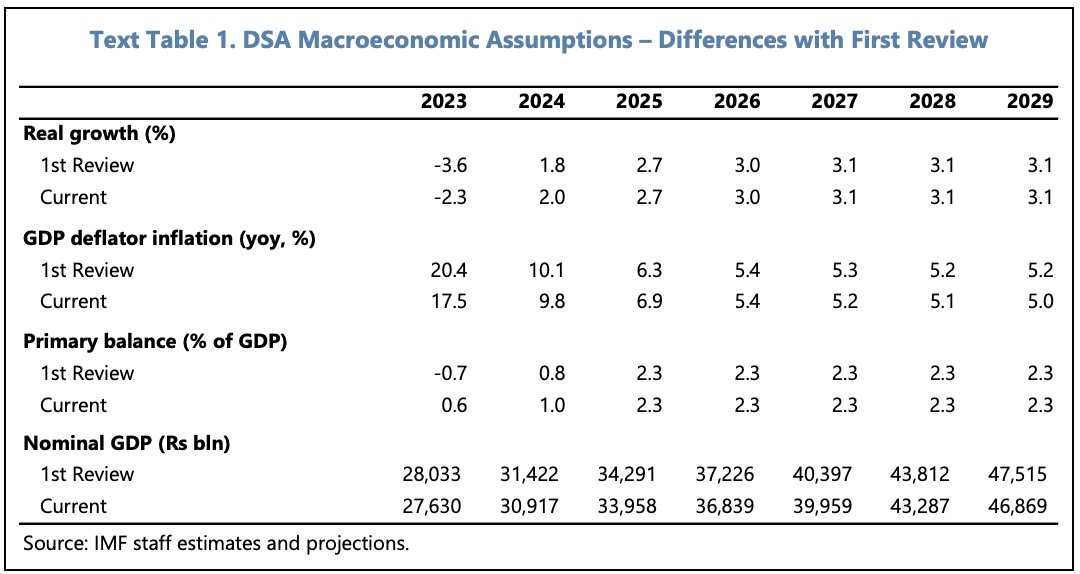

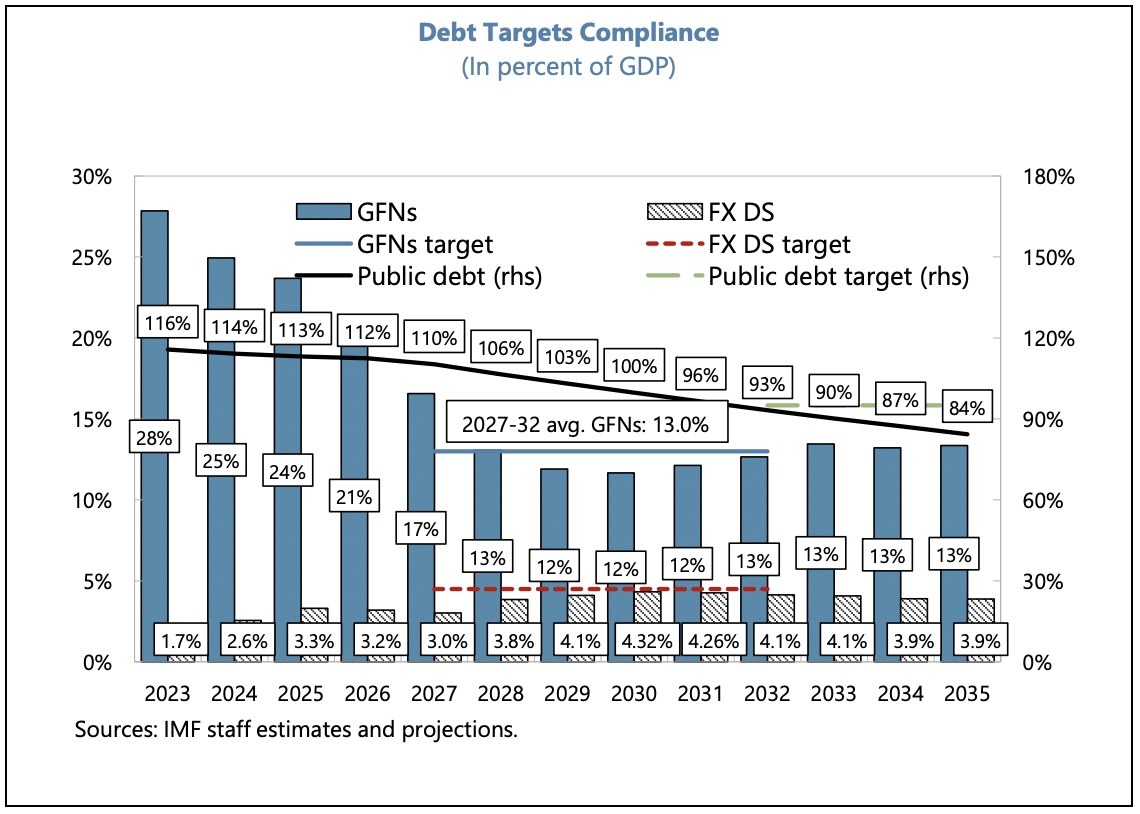

The IMF reports that reforms and policy adjustment are bearing fruit. The economy is starting to recover, inflation remains low, revenue collection is improving, and reserves continue to accumulate. Even so, it believes that the path to debt sustainability is ‘knife-edged’. Strong reform efforts, safeguards, and contingency planning are required to mitigate the vulnerabilities that remain.

The Acting Chair of the Executive Board issued the following remarks:

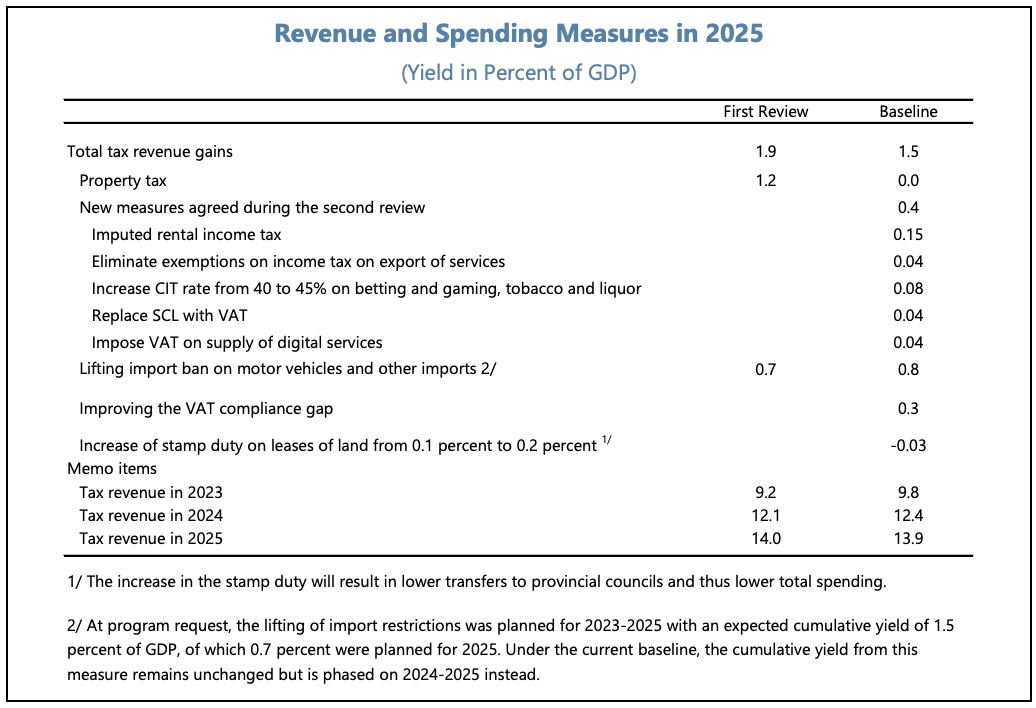

‘To restore fiscal sustainability, sustained revenue mobilization efforts, promptly finalizing the debt restructuring in line with program targets, and protecting social and capital spending remain critical. Advancing public financial management will help enhance fiscal discipline, and strengthening the debt management framework is also needed.

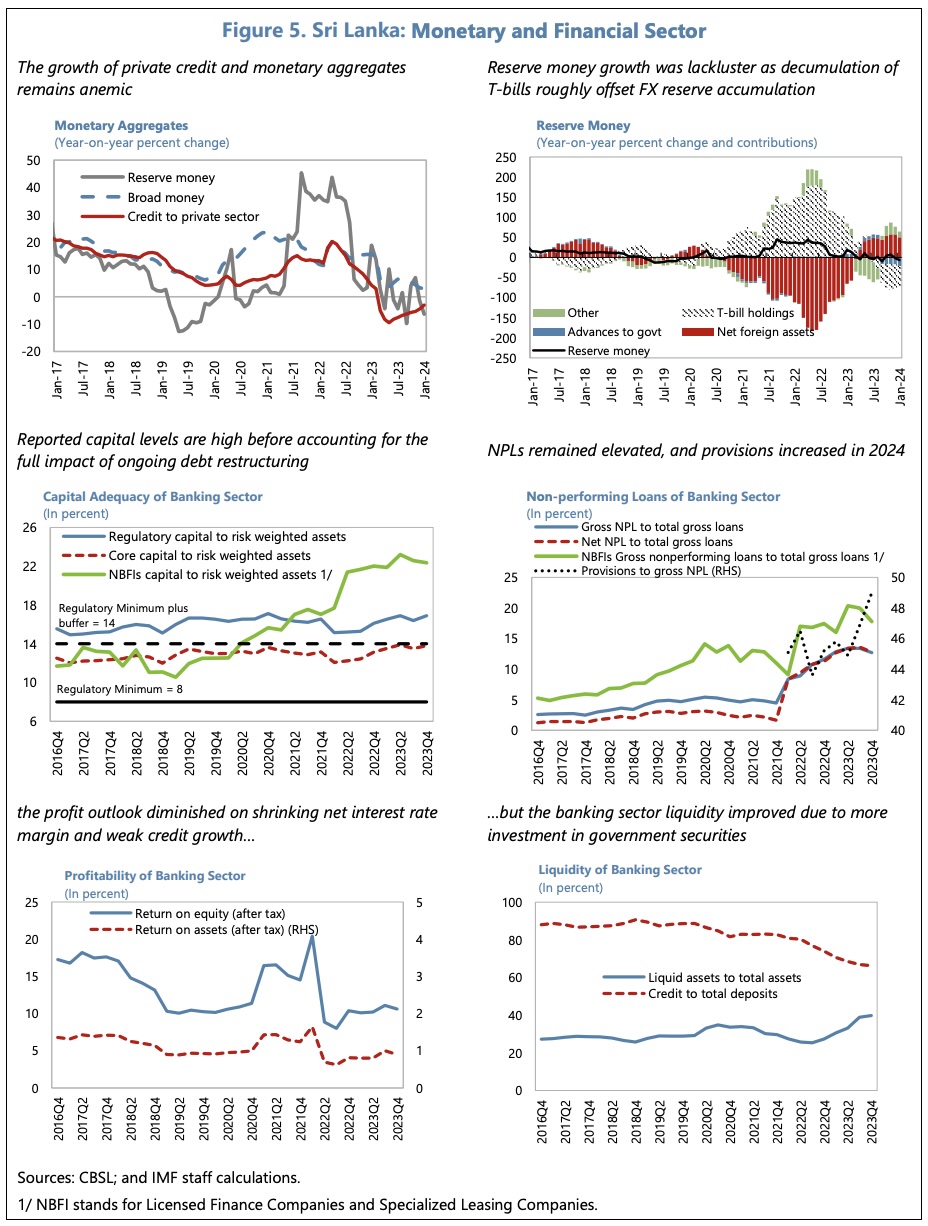

‘Monetary policy should continue prioritizing price stability, supported by a sustained commitment to refrain from monetary financing and safeguard central bank independence. Continued exchange rate flexibility and gradually phasing out the balance of payments measures remain critical to rebuild external buffers and facilitate external rebalancing.

‘Restoring bank capital adequacy and strengthening governance and oversight of state-owned banks are top priorities to revive credit growth and support economic recovery.

‘The authorities need to press ahead with their efforts to address structural challenges to unlock long-term potential. Key priorities include steadfast implementation of the governance reforms; further trade liberalization to promote exports and foreign direct investment; labor reforms to upgrade skills and increase female labor force participation; and state-owned enterprise reforms to improve efficiency and fiscal transparency, contain fiscal risks, and promote a level playing field for the private sector.’

The following tables and charts summarise the IMF’s analysis and projections for the economy. The full Article IV report, including the IMF’s report on Sri Lanka’s Sovereignty Risk and Debt Sustainability (Annex II), may be read using the following link to the IMF’s website: