In August 2024, the IMF published the most recent of its updates on China’s economy under the Article IV Consultation process.

Since the Chinese economy is more than usually topical, we have decided to produce a note summarising some of the IMF’s key observations. The full report may be read using the following link to the IMF’s website:

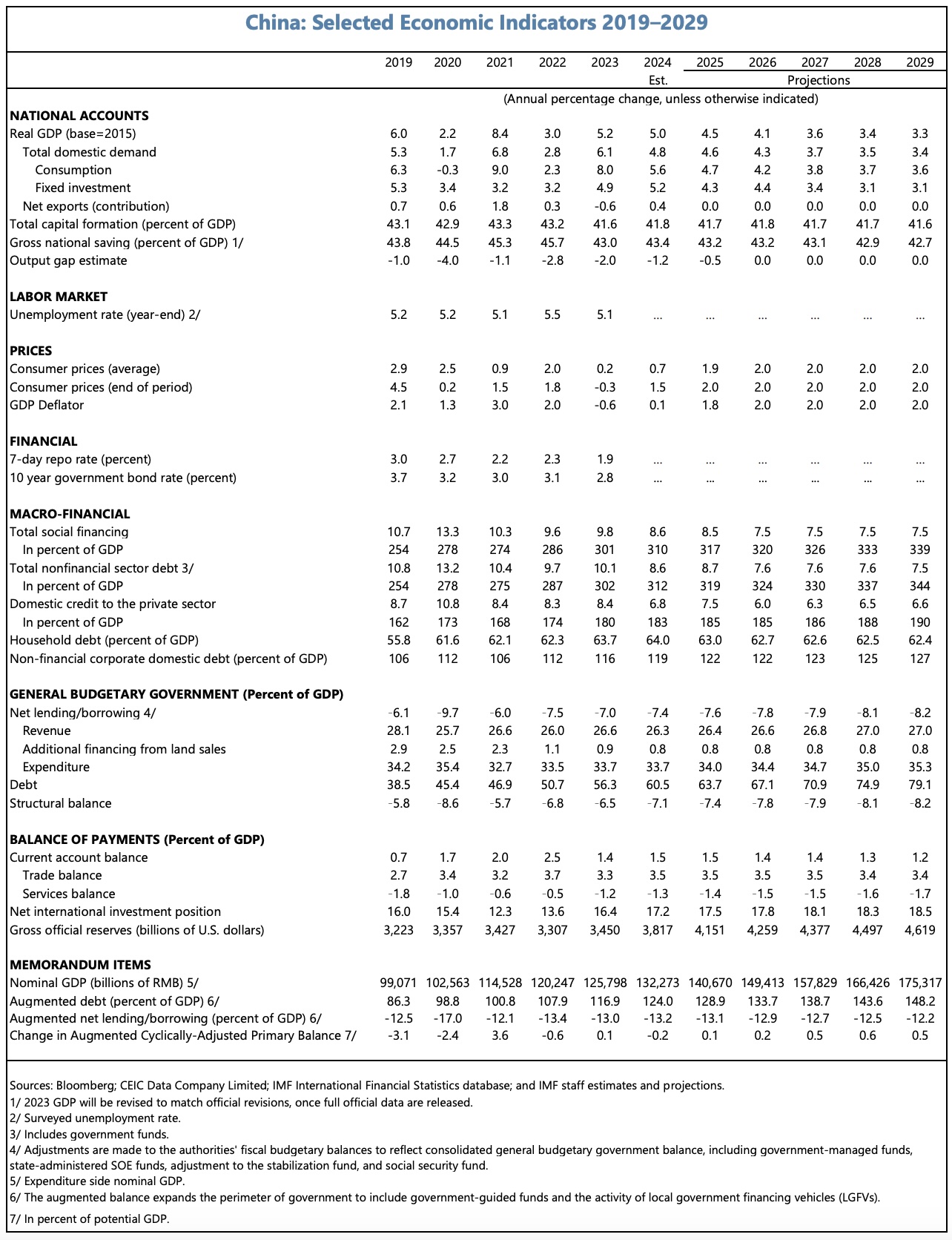

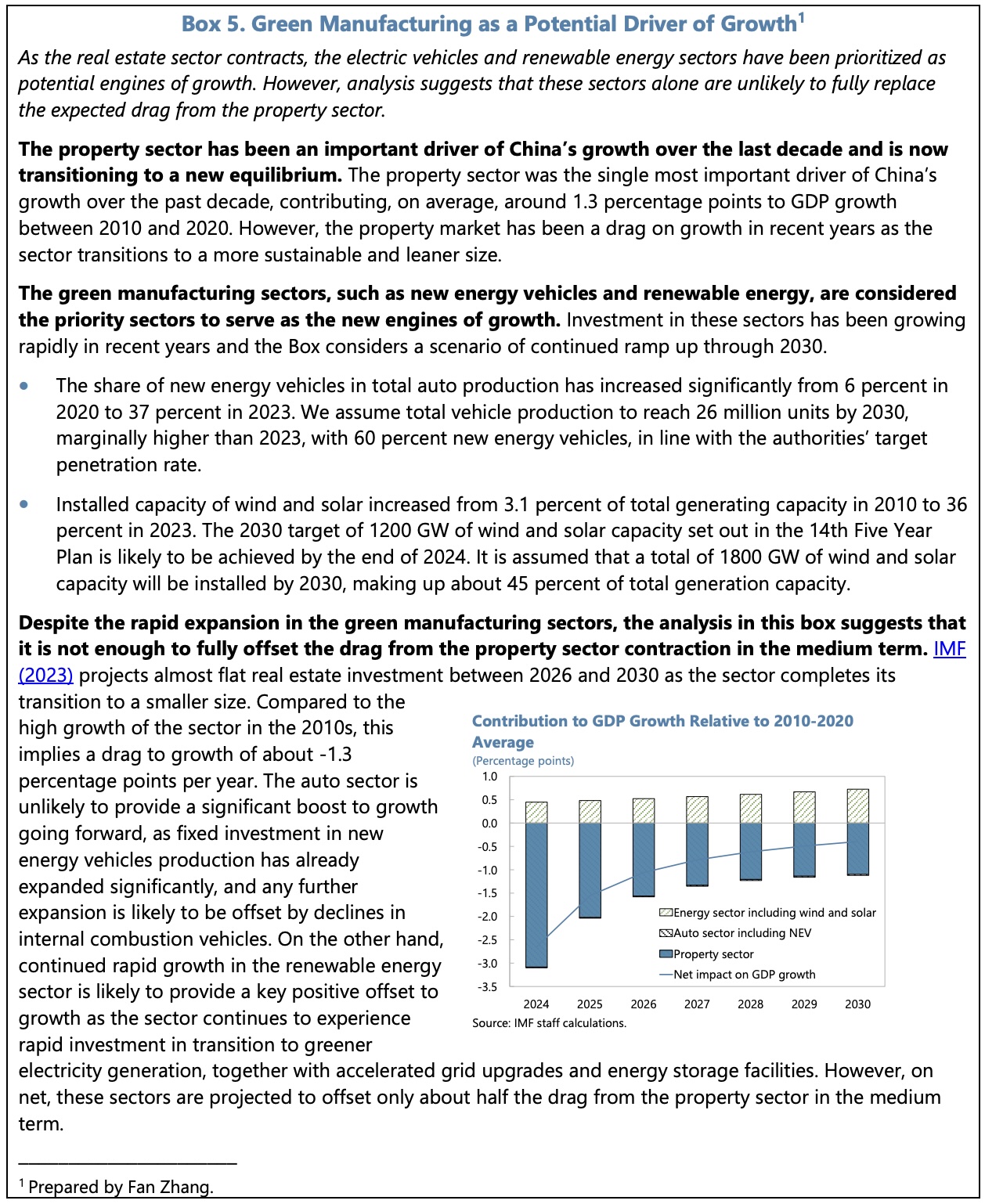

Despite weakness in the property sector, Chinese GDP grew by 5.2% YoY in 2023, and by 5% in H1 2024. The primary drivers have been strong public investment and the post-COVID recovery in private consumption, with net exports also providing a boost more recently. Inflation has been low in recent quarters amid continued economic slack.

For 2024, the IMF is projecting growth of 5%, broadly in line with the government’s target. Inflation is expected to pick up gradually as the output gap closes and the impact of lower commodity prices wanes.

Over the medium term, growth is projected to decline towards 3.3% in 2029, amid headwinds from weak productivity and an aging population.

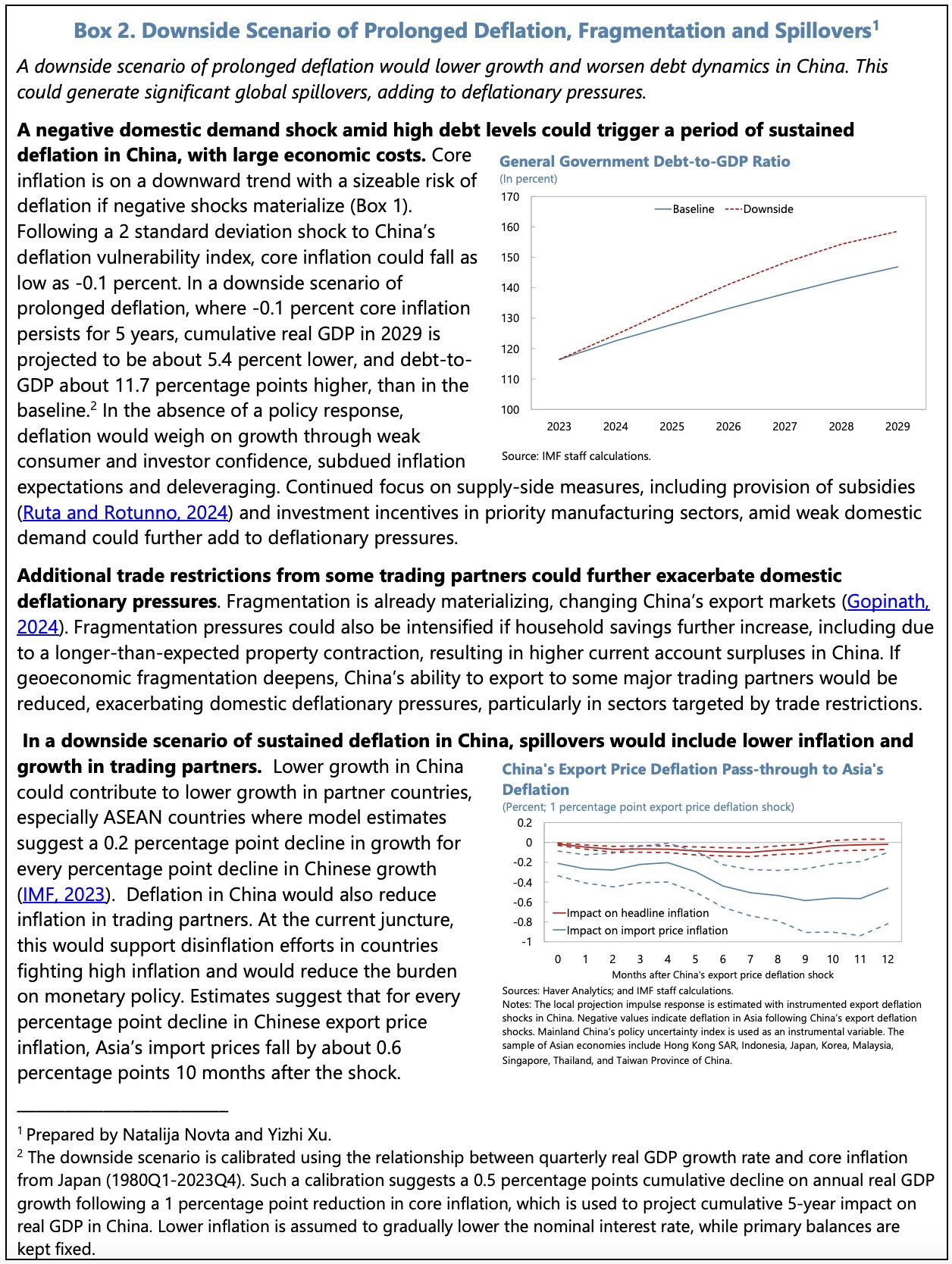

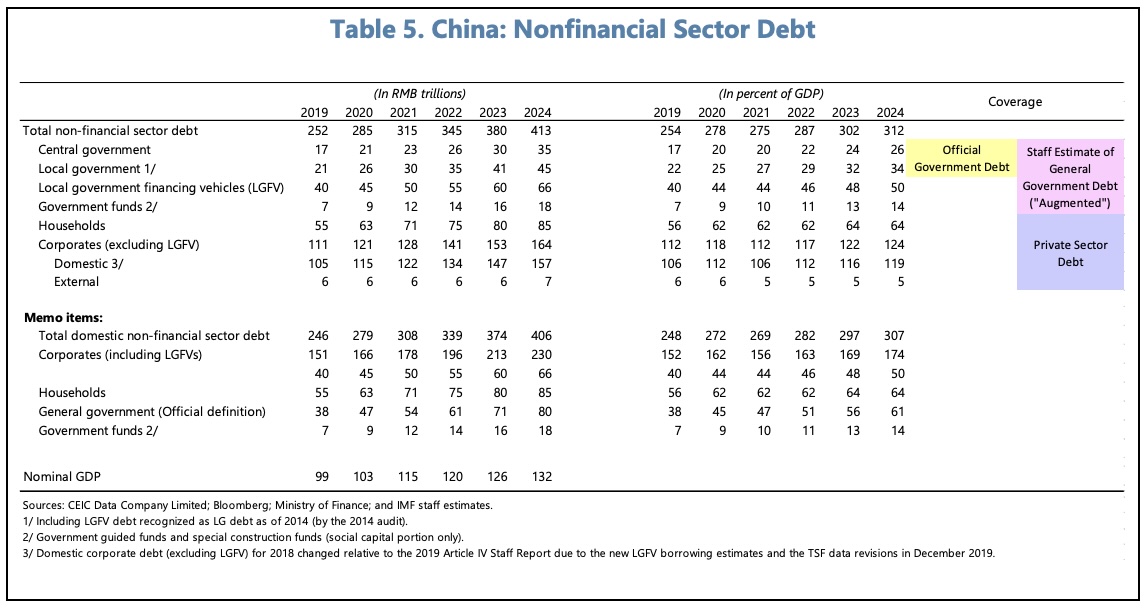

Uncertainty surrounding the outlook is high. Deeper-than-expected contraction in the property sector, coupled with high debt, could result in sustained disinflationary pressures with macro-financial feedback consequences. External risks include weaker external demand and an escalation of fragmentation pressures. On the upside, decisive policy action to facilitate adjustment in the property sector or market-oriented structural reforms could boost confidence.

Whilst they have welcomed China’s resilient growth, the IMF Directors have emphasised downside risks from adjustment in the property market and the drag from local government debt. They concurred that macroeconomic policies should support domestic demand in the short term.

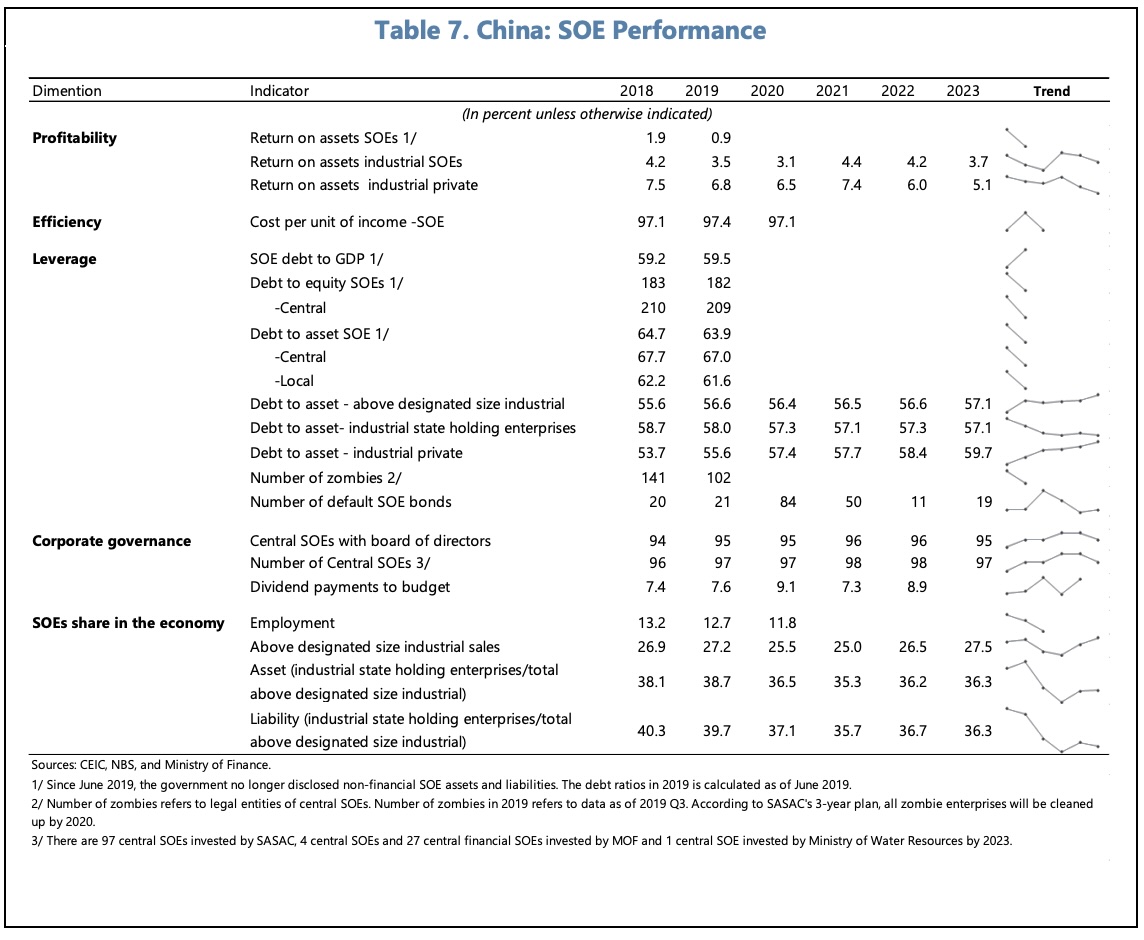

In the medium term, they favour a balanced policy approach, arguing that pro-market structural reforms are necessary to foster high-quality, green growth.

Regarding the property sector, the Directors called for the timely exit of non-viable property developers and greater house price flexibility. Most saw scope in the deployment of central government financing to protect homebuyers of unfinished housing, while some noted the associated fiscal costs and moral hazard.

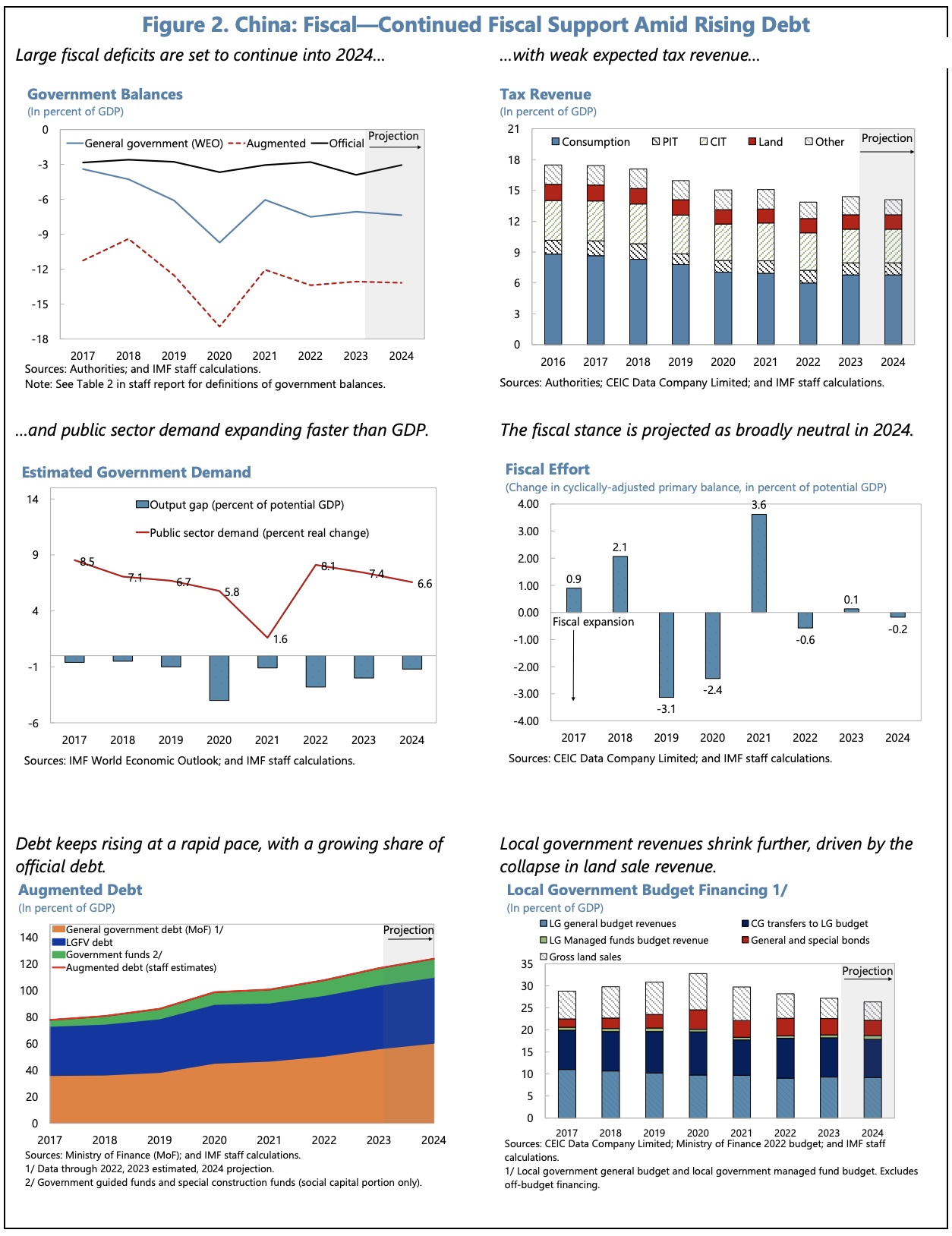

The Directors agreed that a neutral structural fiscal stance in 2024 would help restore consumer confidence and support domestic demand. They felt that the positive effects would be strengthened with a reorientation of expenditure away from investment and toward households, through expanded social protection, including greater transfers to vulnerable segments and more progressive taxation.

The Directors felt that a gradual decline in the structural fiscal deficit could begin in 2025. In the longer term, sustained fiscal consolidation is required, to be achieved through a reduction of off-budget investment and wide-ranging tax and social security reforms. The Directors highlighted the need for improved monitoring of local government finances, reducing their structural expenditure-revenue gaps, and establishing sub-national fiscal rules. The greater use of insolvency tools is required to reduce the debt stock of local government financing vehicles.

The Directors have welcomed the People’s Bank of China’s monetary policy stance. They support additional monetary easing via interest rates, to boost domestic demand and mitigate deflation risks, and greater exchange rate flexibility, to absorb external shocks.

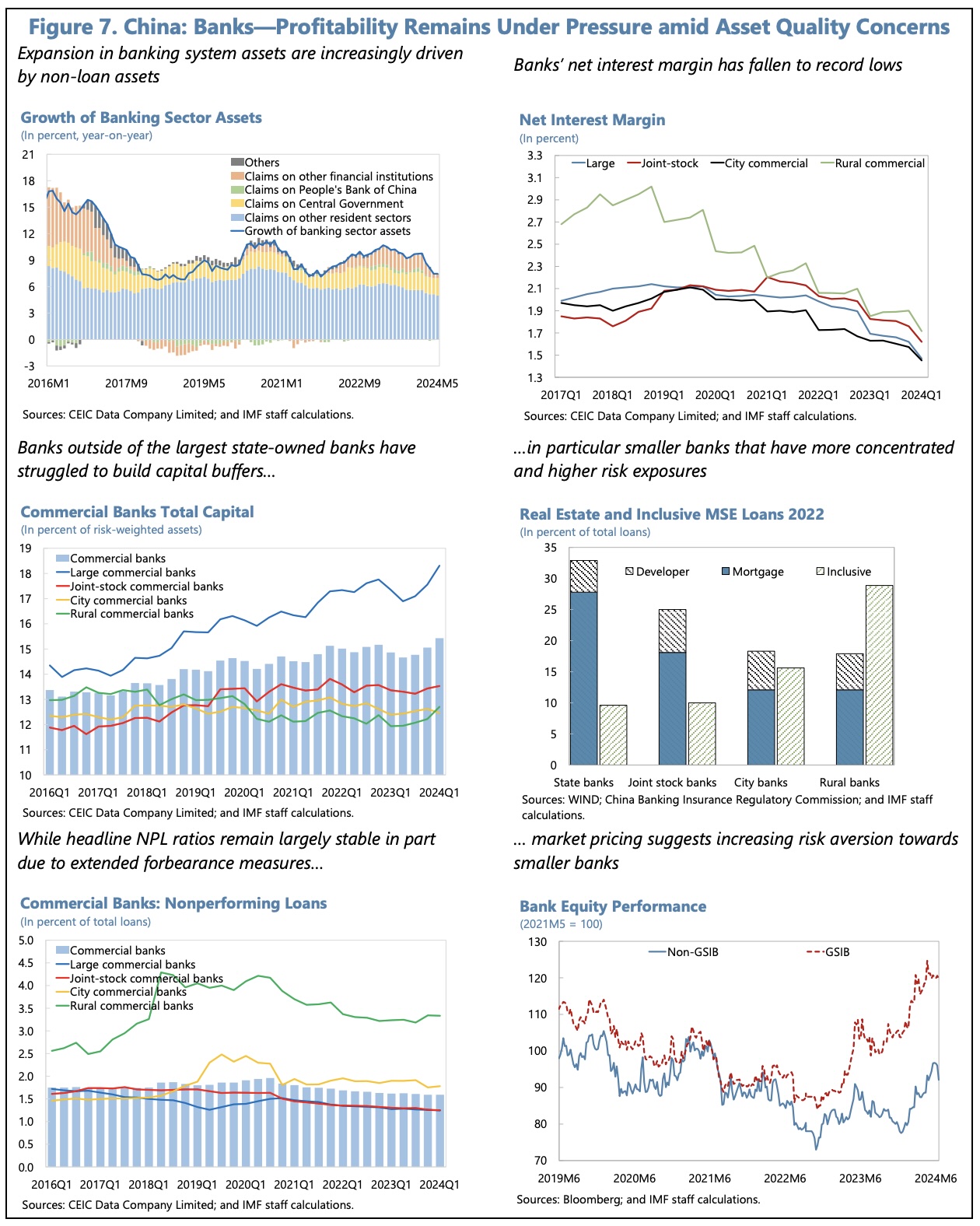

They have also welcomed significant changes to China’s financial regulatory and supervisory architecture. However, financial stability risks remain elevated. To reduce asset quality risks, they advocate phasing out forbearance measures and strictly applying prudential policies. To tackle vulnerabilities in the financial system, they see a need for a comprehensive strategy to strengthen small and medium banks, upgrade crisis management and bank resolution frameworks, and enhance systemic risk oversight. The AML/CFT framework needs to be strengthened.

The Directors emphasized the need for greener and more balanced growth. Continued efforts are needed to rebalance demand toward consumption and to boost the service sector, including by reducing regulatory barriers. Other reform priorities include implementing SOE reforms, gradually increasing the retirement age, and strengthening labour market policies.

The Directors welcomed China’s decarbonization efforts and its success in deploying renewable energy. They urged accelerating power sector reforms, including reforms to the emission trading system.

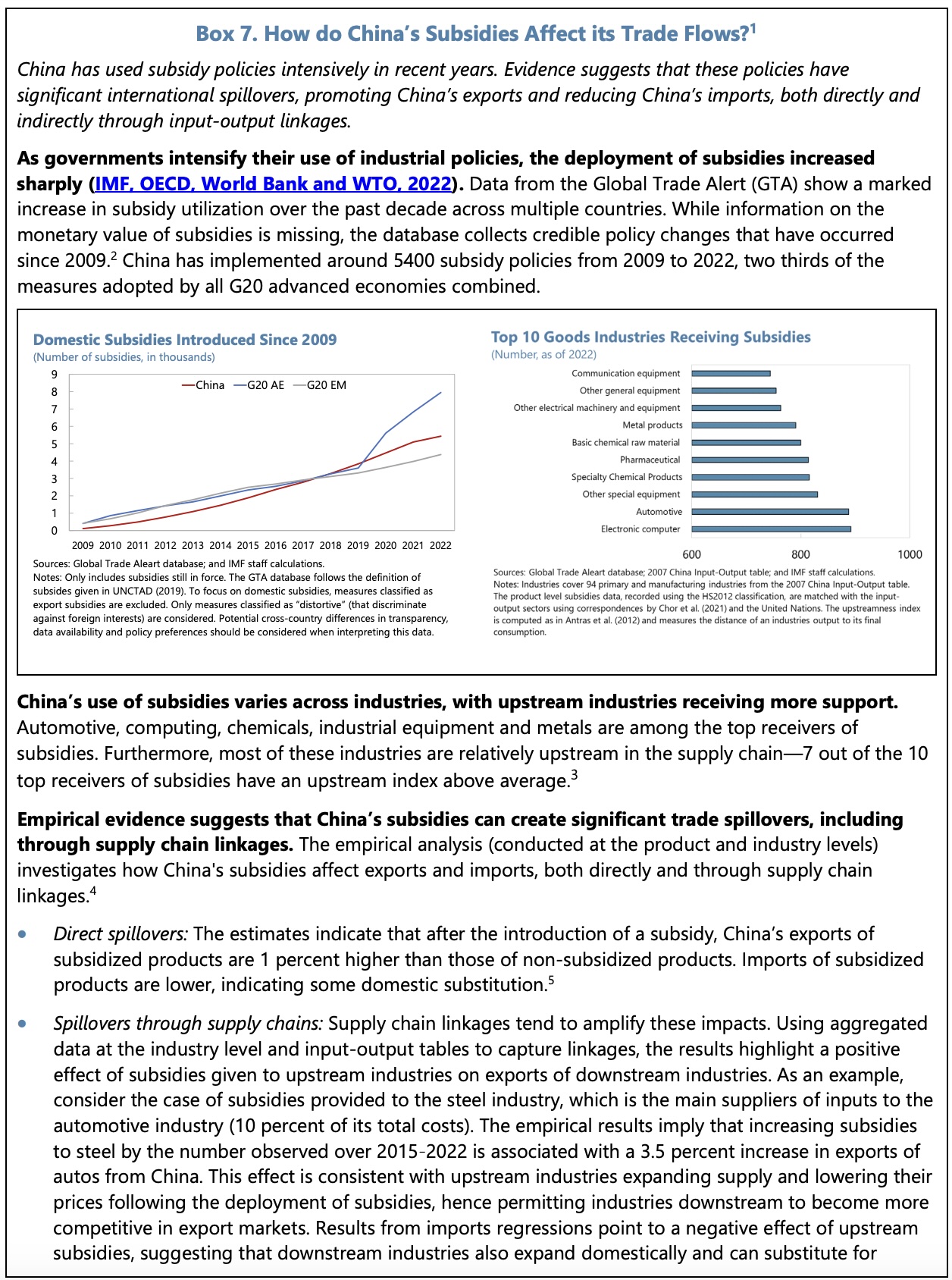

The Directors have also welcomed China’s constructive role in supporting sovereign debt restructuring in low-income countries, and in tackling the global climate crisis. However, they also emphasized China’s important role in strengthening the multilateral trading system in collaboration with international partners. In that context, scaling back industrial policies (to be used only in the presence of well-defined market failures) and improving transparency around government support could help reduce domestic resource misallocation, lessen fragmentation pressures, and mitigate international spillovers.

Finally, the Directors agreed that addressing remaining data gaps would help enhance transparency and strengthen policy making.

The following tables and charts summarise some of the IMF’s key observations about the economy, their projections for the future and their thoughts about some of the key risks and reform requirements. For full details, readers should refer to the IMF’s report using the link provided above.