In September 2024, the IMF issued its latest report on the Vietnamese economy under its Article IV consultation process.

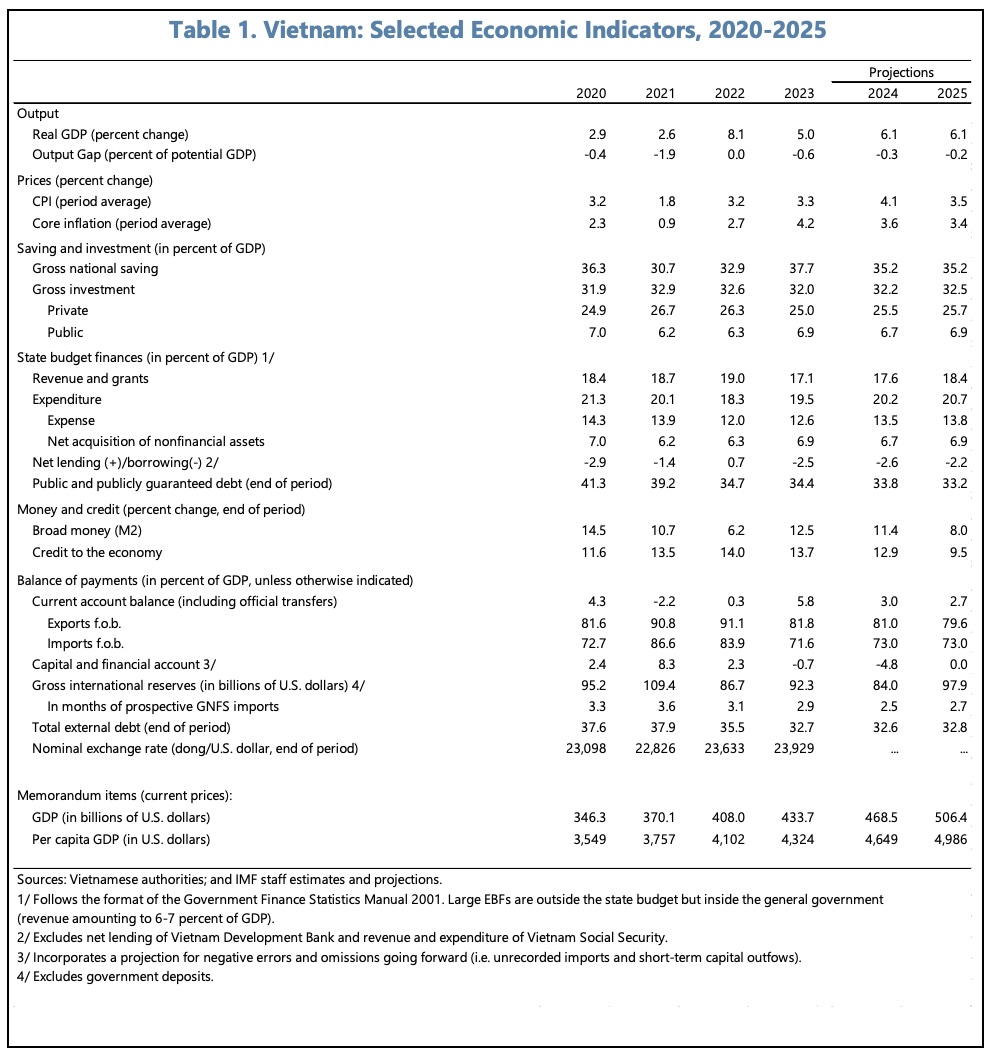

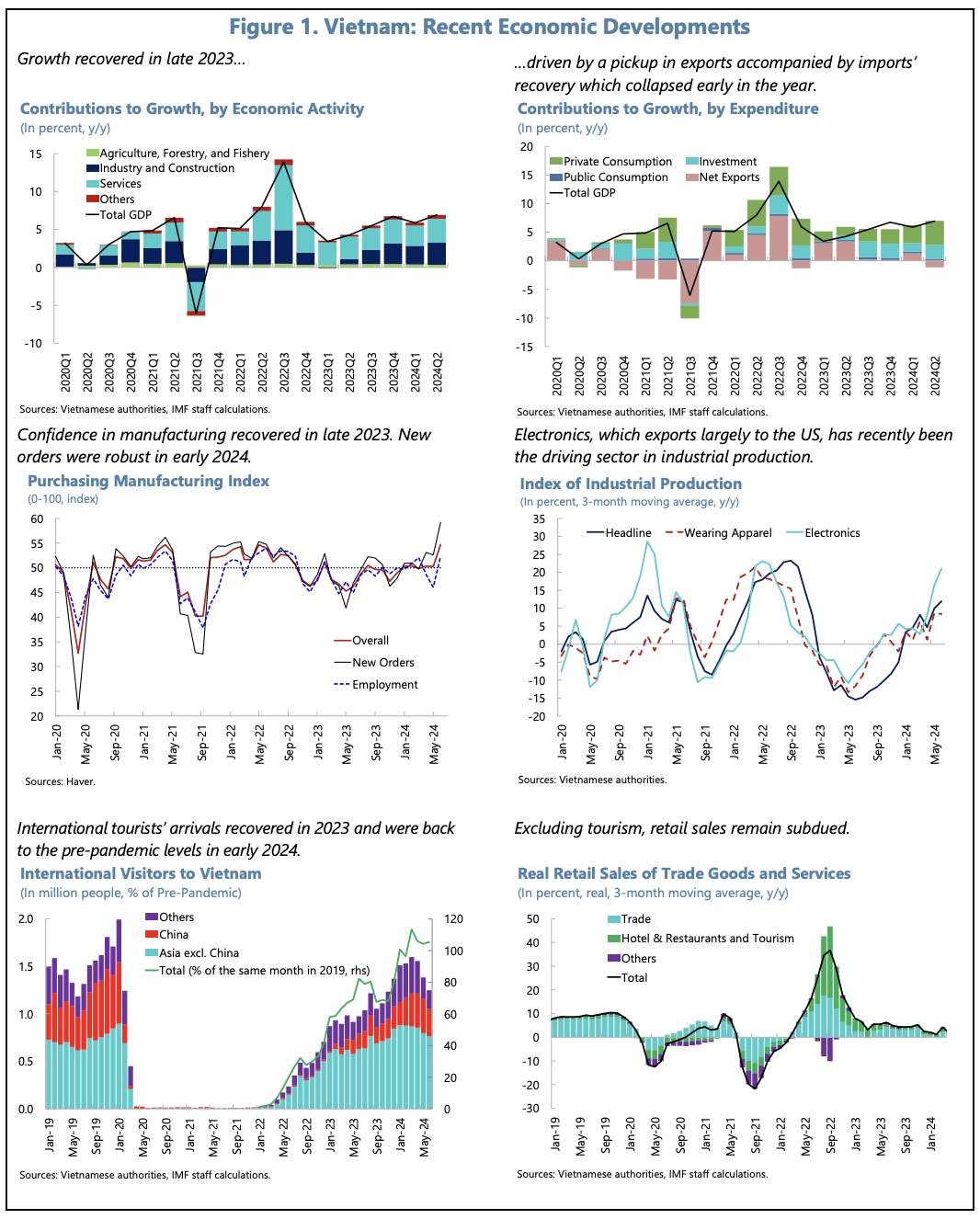

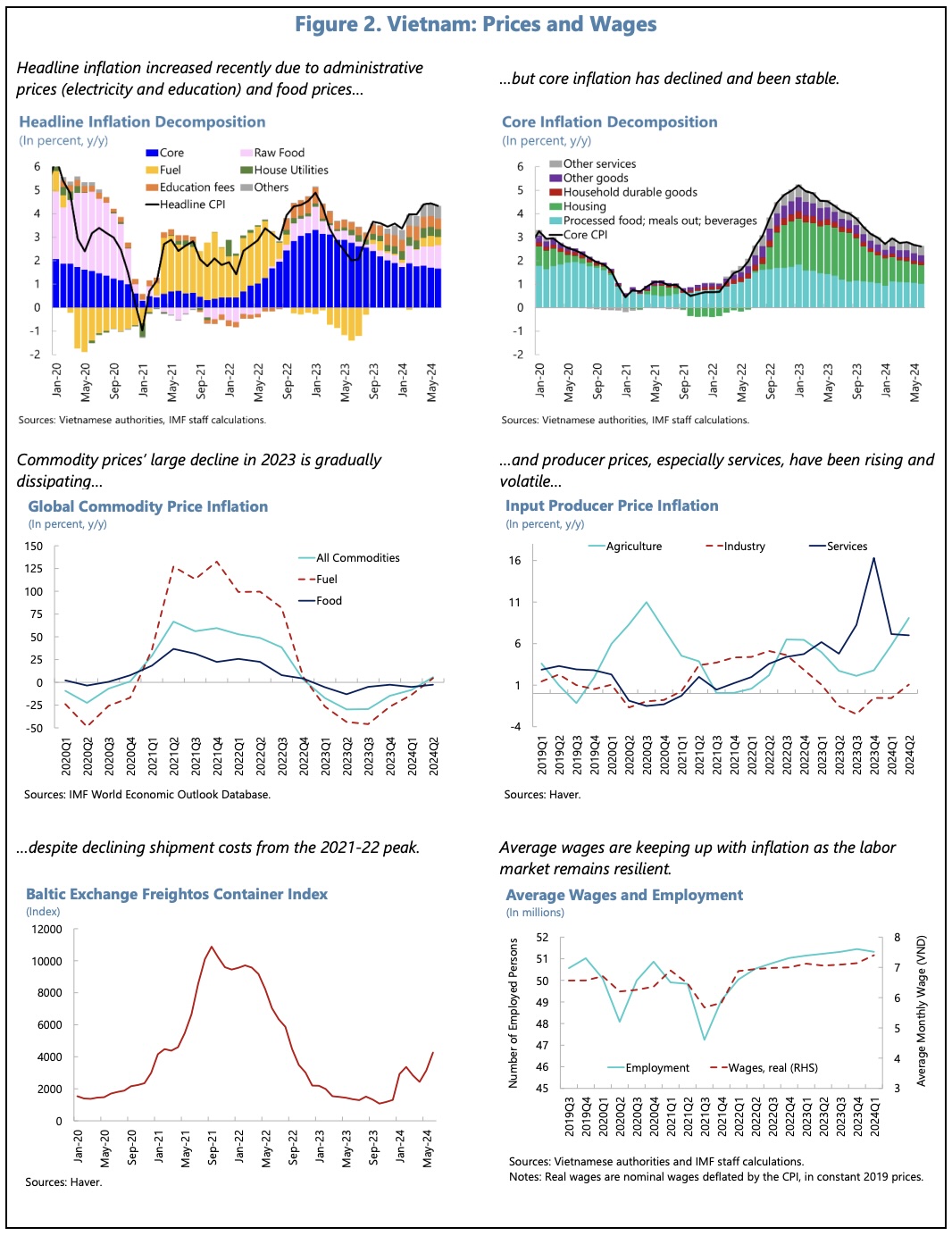

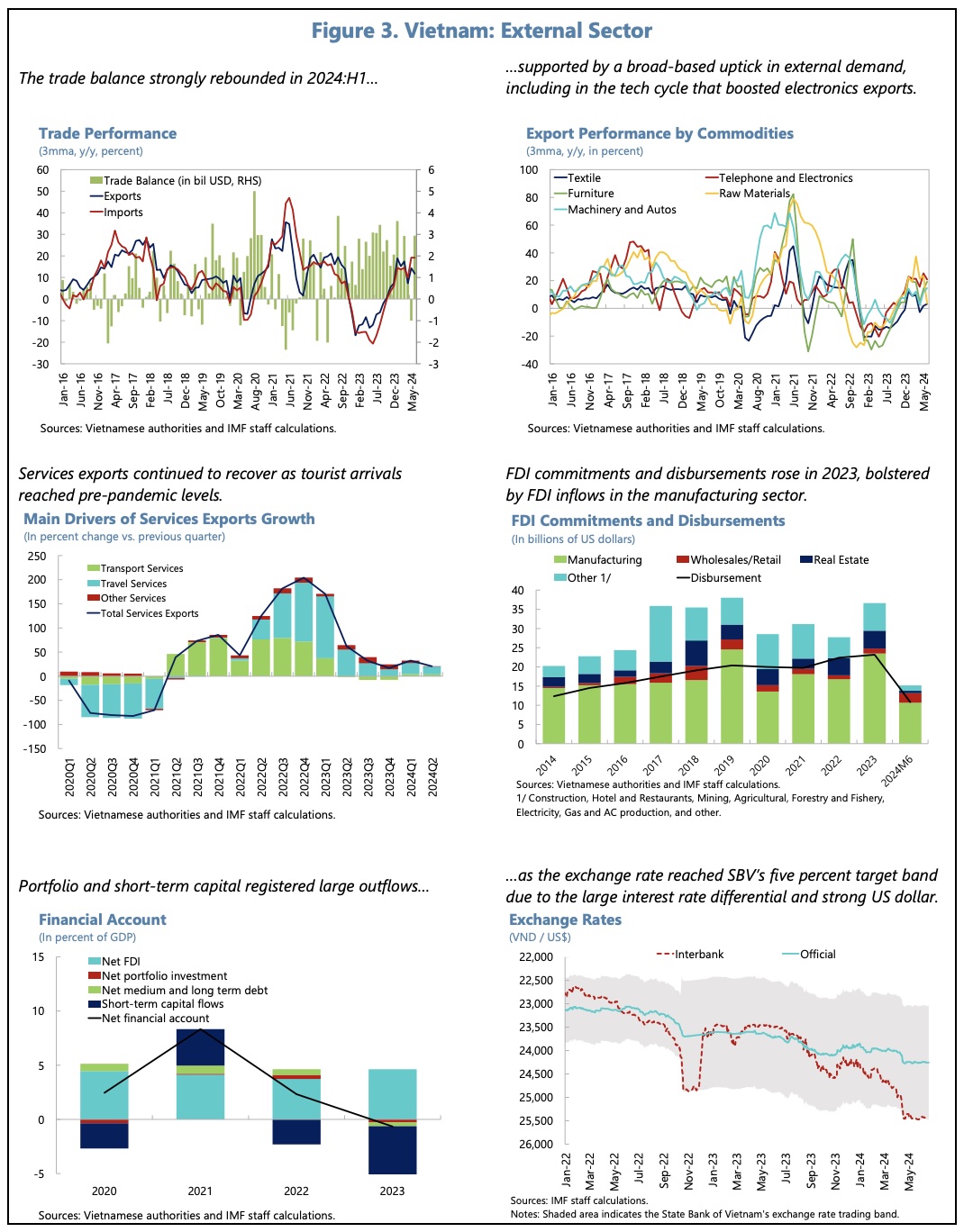

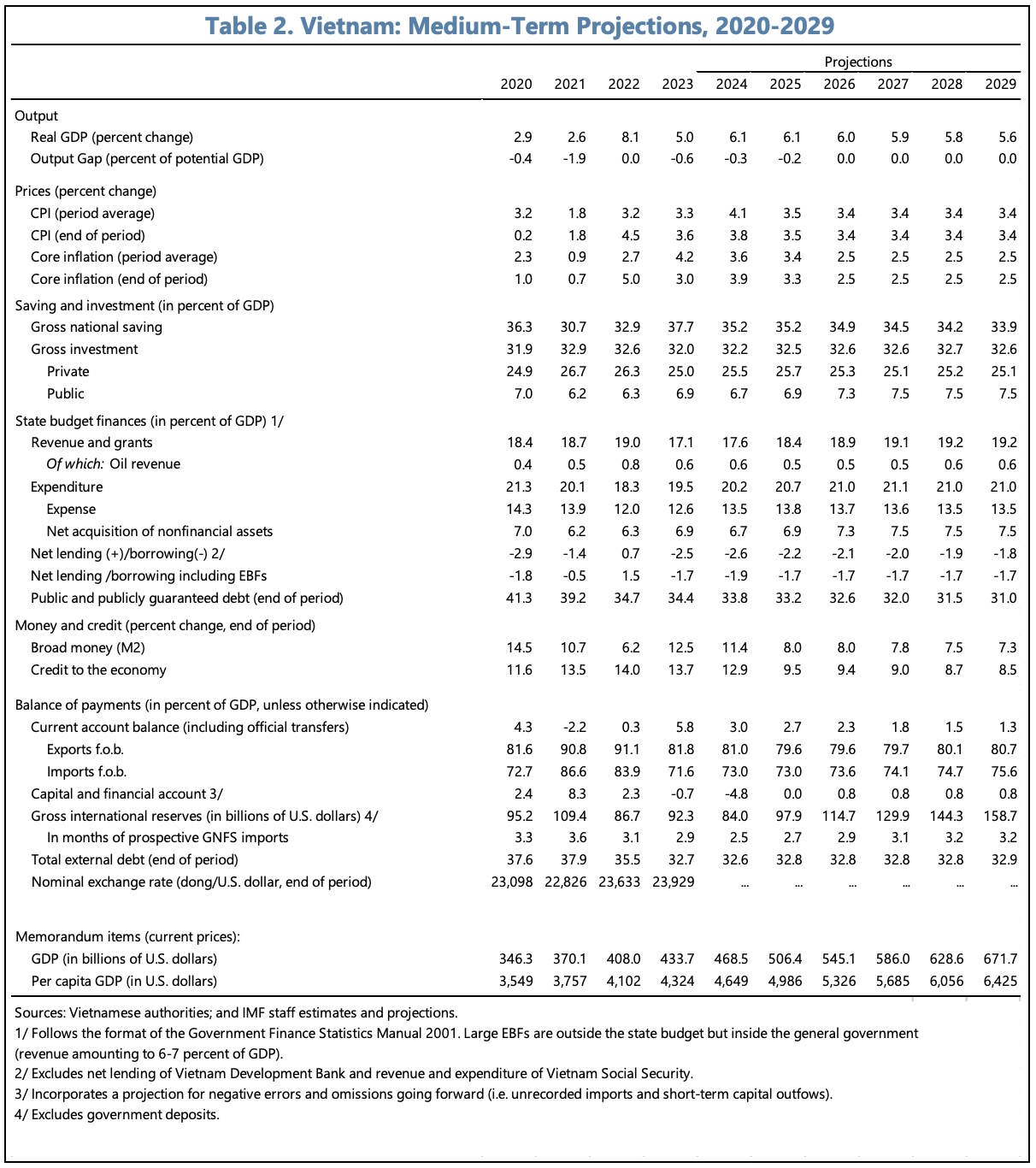

In 2024, it expects real GDP growth to recover to 6.1% from 5% in 2023. Growth should be supported by an acceleration in exports, FDI, tourism, and supportive economic policies. Domestic demand is expected to rise gradually, as corporates navigate their debt challenges. The real estate market is expected to improve only over the medium term. Inflation is expected to remain close to target, at 4% to 4.5%. Core inflation (ex. food) remains low.

Risks are to the downside – from global growth/trade tensions and potential barriers. Easy monetary policies could cause inflationary pressure if the currency weakens. There are persistent challenges in the real estate and bond markets, which may limit the banks’ willingness to lend.

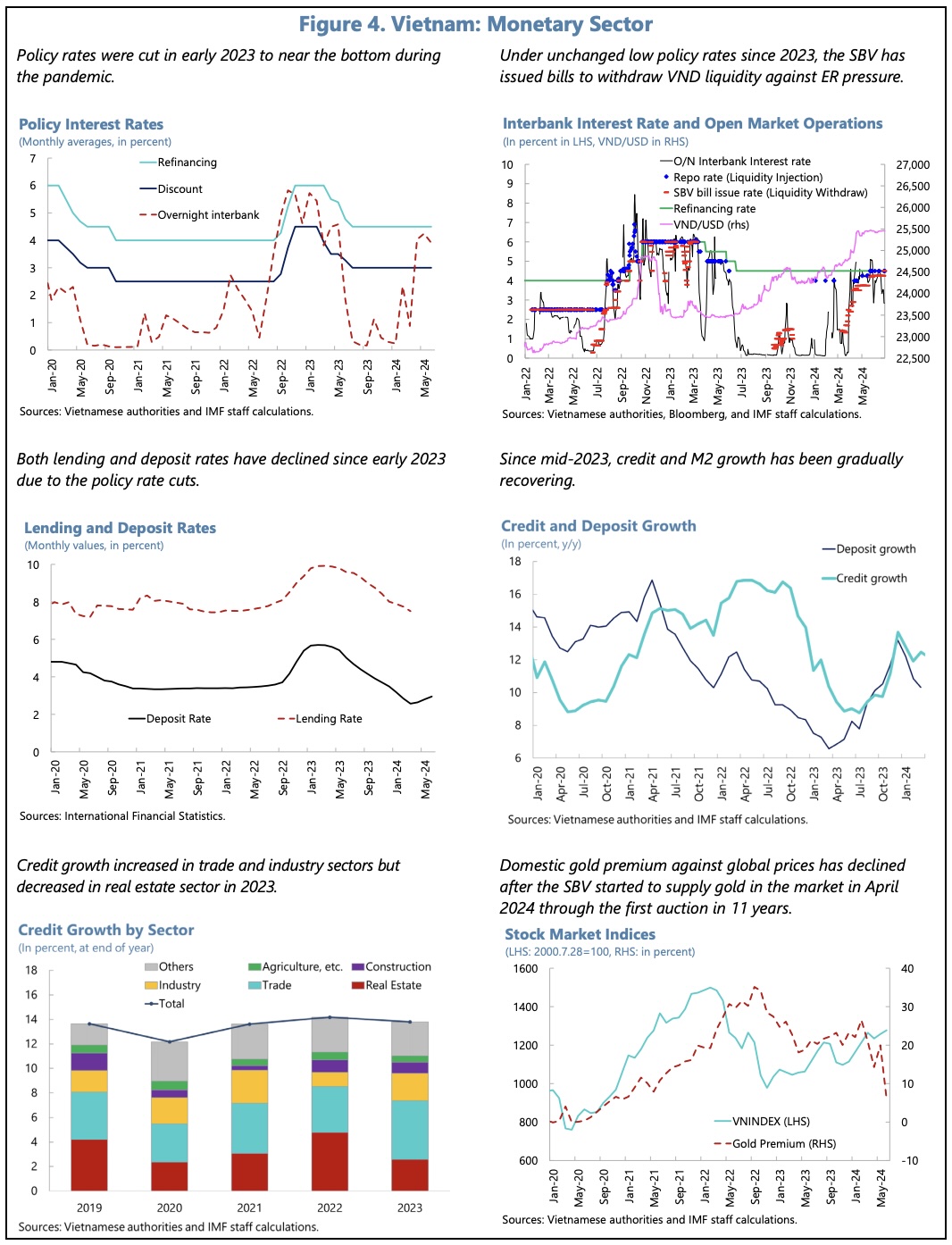

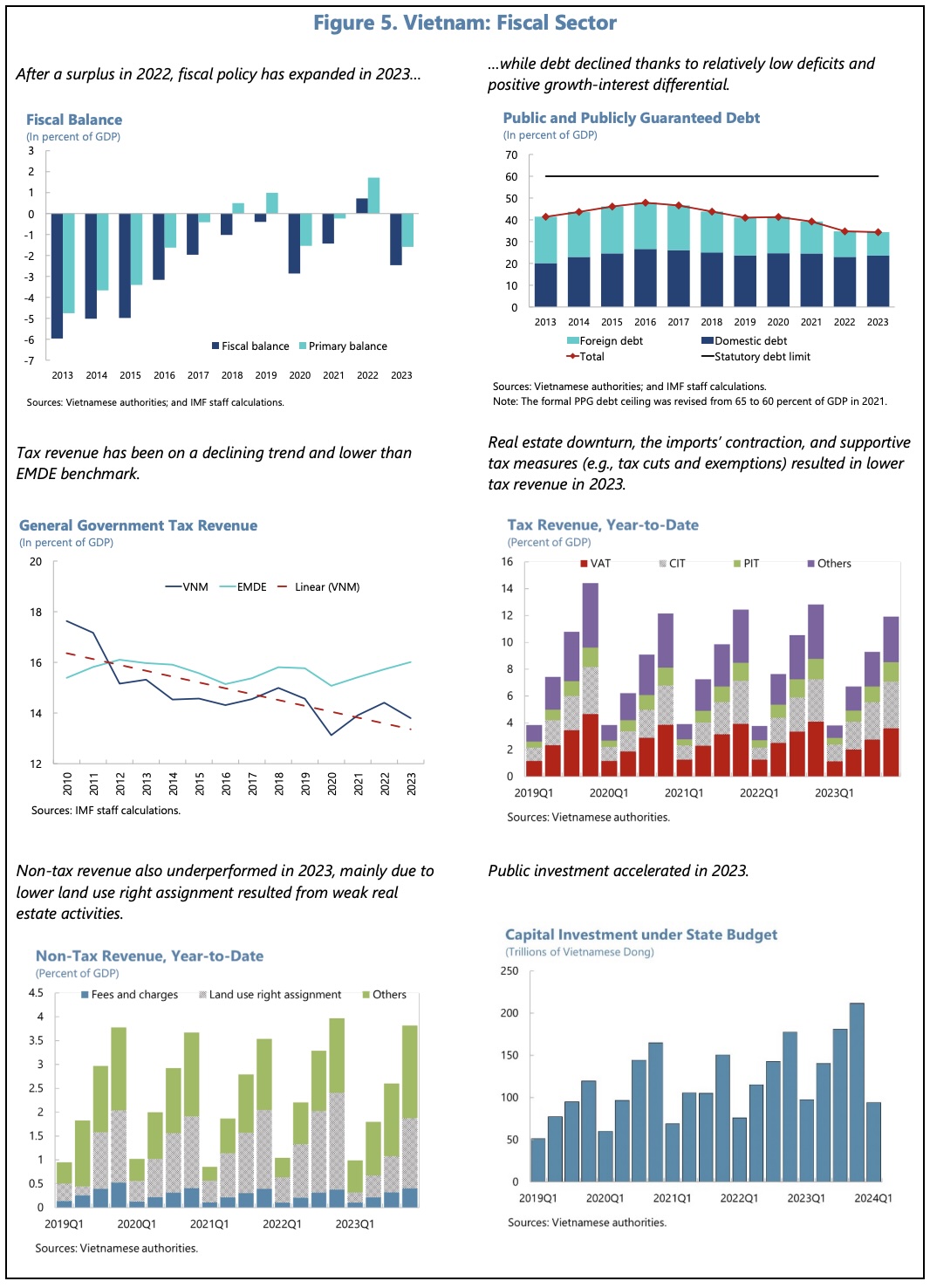

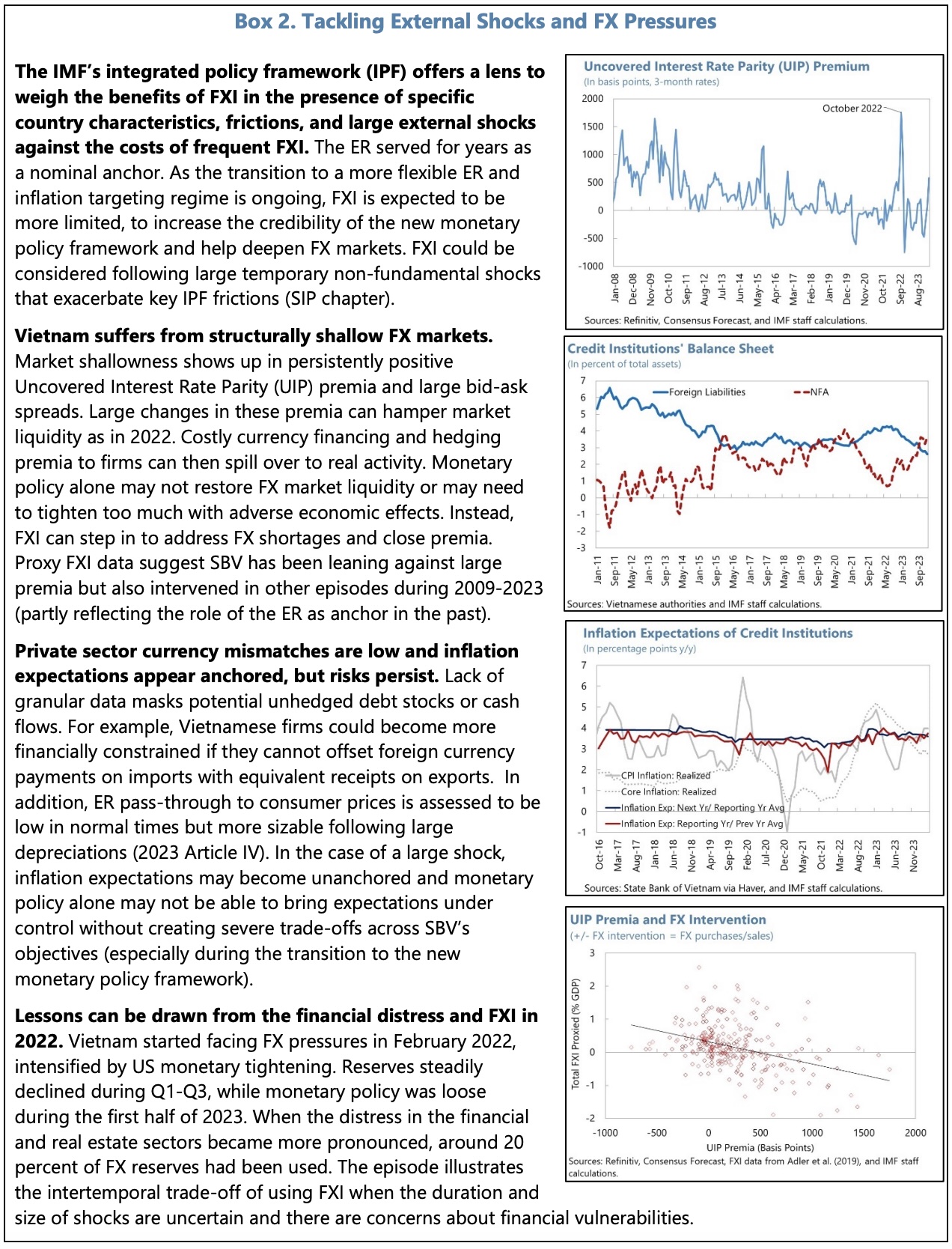

The Executive Board has suggested that, as there is limited scope for monetary loosening, fiscal policies should lead economic support, if needed. (The fiscal balance moved from a surplus of 0.7% GDP in 2022 to a deficit of 2.5% GDP in 2023, but public sector debt is well below the 60% of GDP ceiling). It supports accelerated public investment (with greater transparency) and a focus on resolving bottlenecks (which facilitate private sector deleveraging), and the expansion of social safety nets. It argues there is a need for reforms in the fiscal framework and budgeting processes, as well as revenue mobilisation (VAT/excise/unified property tax/changes to income tax thresholds). (Historically, tax revenues, at around 15% GDP have been at the low end of the Asian range.) It supports increased greater operational autonomy for the state bank, a streamlined focus on inflation targeting, the phasing out of deposit and lending rate caps, and increased FX flexibility (whilst noting that the exchange rate band was widened to 5% in 2022).

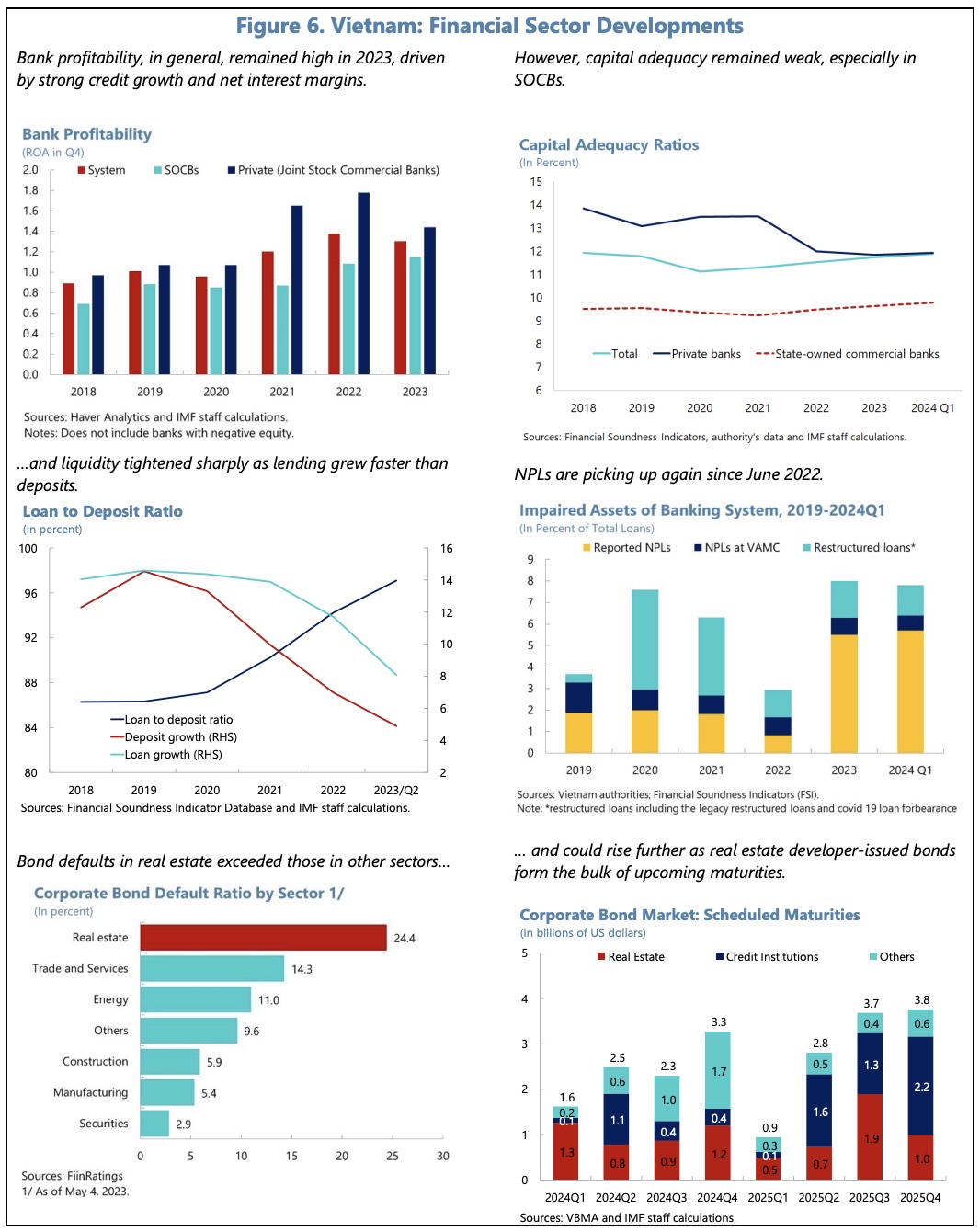

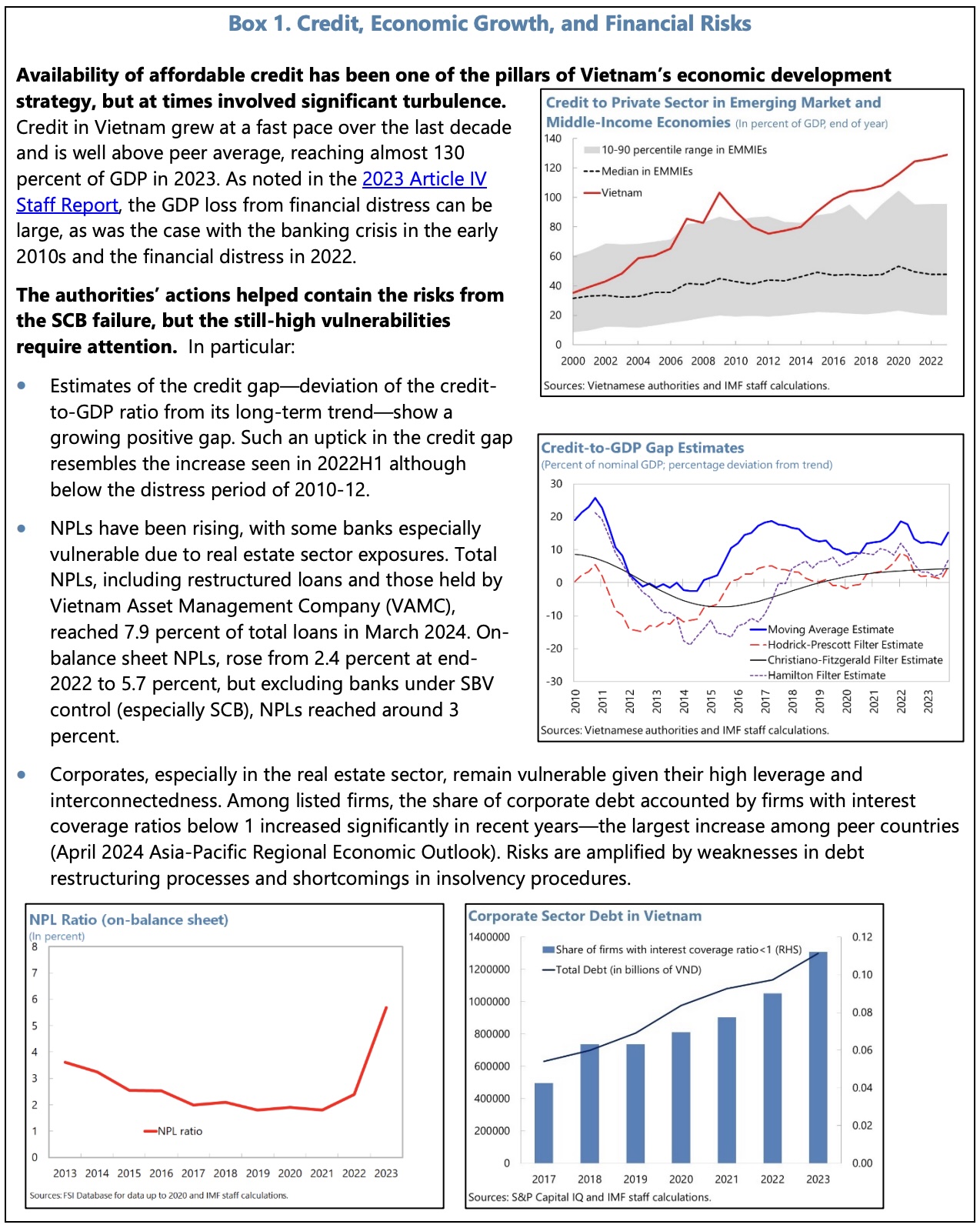

In the financial system, it advocates strengthened capital buffers, tighter controls on regulatory forbearance and action to address rising NPLs (now at a decade-high). It approves of the revised law on credit institutions, which aims to improve supervision/crisis preparedness), and argues for strengthened frameworks for NPL resolution and emergency liquidity. Bolstering institutions and the solvency framework are also needed in the context of the challenges facing the real estate and corporate bond markets. Credit to the private sector, at around 130% GDP, is high by the standard of peer economies. Total NPLs, including restructured loans, reached 7.9% of total loans by March 2024. Among listed firms, the share of corporate debt held by firms with interest cover below 1 has risen sharply to around 11%.

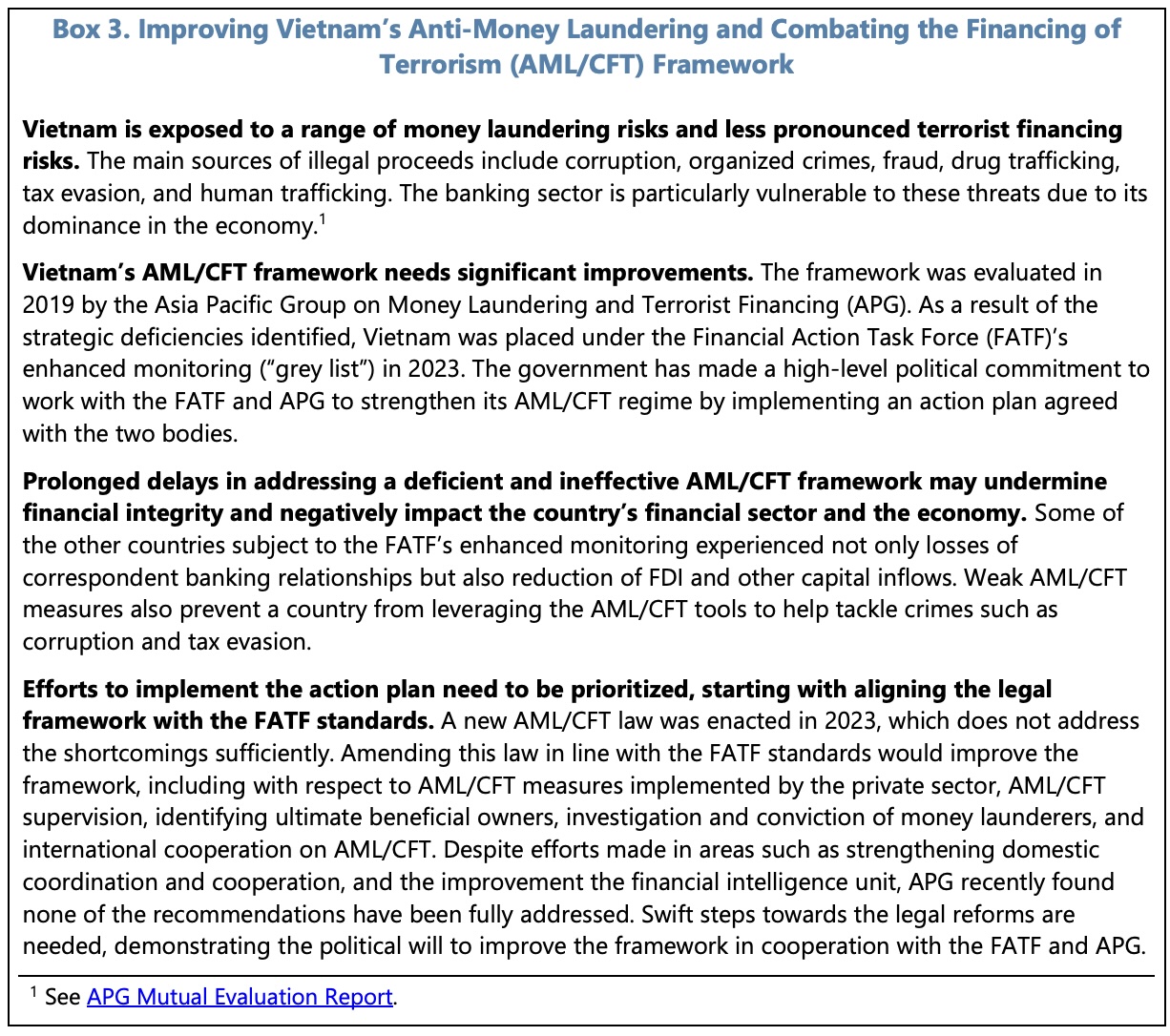

To assist in the transition to middle-income status, the IMF sees the need for further efforts to improve the business environment, critical infrastructure and human capital. It has welcomed the authorities’ anti-corruption efforts and emphasised the need to continue strengthening governance, improve the AML/CFT framework and simplify regulatory frameworks.

The following tables and summarise the IMF’s assessment of the economy of of the outlook. The full report may be read using the following link: