Overview

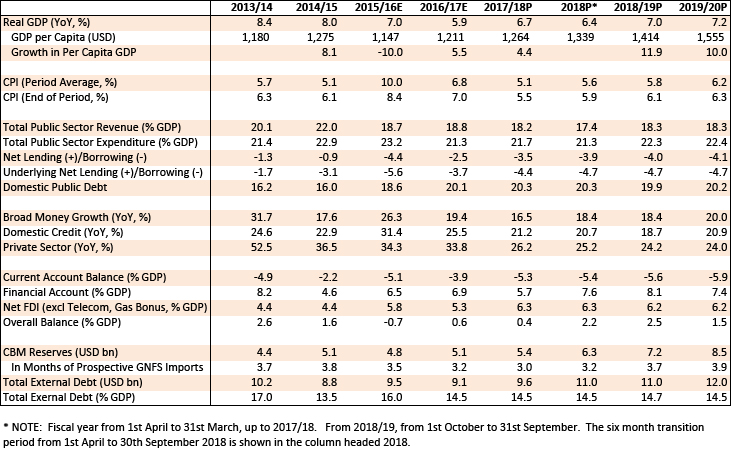

The Myanmar economy “stabilized” in 2016/17. Weak agriculture production and exports, and a temporary suspension of construction projects in Yangon, meant that growth was lower than expected at 5.9%. However, the fiscal deficit fell from 4.5% of GDP in the election year, to 2.5% in 2016/17, which helped to reduce central bank deficit financing. Inflation moderated to 6.8% and the current account deficit fell from 5.1% in 2015/16 to an estimated 3.9% in 2016/17. The current account continues to be mainly financed by FDI, with the real exchange rate and FX reserves broadly stable.

Looking forward, the IMF concludes the outlook “remains favourable”, although growth is moderately weaker than previously anticipated, due to a subdued pick-up in investment and the uncertainties in Rakhine impacting tourism in particular. However, strong endowments such as demographics, a competitive labour force and strategic location remain in place to underpin convergence.

Growth is expected to rebound to 6.7% in 2017/18, supported by agriculture and exports. (Rice and garments exports are growing at above 40% YoY in 2017/18 and natural gas exports are expected to receive a boost as contracted prices reset with a lag.) Higher fiscal spending on the back of “buoyant” tax revenues should also support growth. The medium term potential growth rate is estimated at 7% to 7.5%, “reflecting continued large FDI inflows and an improvement in public investment spending and efficiency.” Headline inflation is projected to decline to 5.5% in 2017/18.

The risks however are “tilted to the downside.” The banking sector needs to adjust to new prudential regulations after a period of “rapid” credit growth. The humanitarian crisis in Rakhine could affect development finance and investor sentiment and, although the direct economic impacts of it have so far been largely localized, “the social costs and full impacts of the crisis are still unfolding.” Additional risks stem from commodity prices, potentially volatile global financial markets, exposure to spillovers from China, and the risk of natural disasters.

On the upside, the implementation of a more detailed strategic reform plan and higher infrastructure investment would raise potential growth. According to the IMF, “reform sequencing and implementation would benefit from increased private sector consultation and an overarching development plan anchored by a medium term fiscal framework.” Structural reforms should focus on agriculture, the banking system and interest rate liberalization, infrastructure, trade and the legal framework.

Recommendations

“Expressing their strong concern”, the IMF Executive Directors have highlighted the need for early and tangible progress towards peace and regional inclusion. They have also called for a second wave of reforms to sustain Myanmar’s economic transition. They commended the release of Myanmar’s Sustainable Development Plan, and recommended it be expanded to address reform sequencing and regional disparities.