Politics – President Sirisena appoints Rajapaksa as Prime Minister in a surprise move

On 26th October 2018, there was a surprising realignment in Sri Lankan politics when President Sirisena sacked Prime Minister Wickremesinghe and replaced him with ex-president Rajapaksa.

The move follows the withdrawal of the United Peoples Freedom Alliance (UPFA), supporting President Sirisena, from the unity government that was formed with Mr Wickramesinghe’s United National Party (UNP) after the 2015 general election.

The unity government had been formed in order to defeat Rajapaksa’s bid for re-election, although Sirisena had previously served as a minister in the Rajapaksa government.

Departing prime minister Wickremesinghe is arguing that his sacking and replacement by Mr Rajapaksa is unconstitutional, as he and the UNP coalition still command a majority in parliament, with 113 out of 225 seats.

The Sri Lankan constitution was amended in 2015 to prevent the president from sacking the prime minister unless he had lost the confidence of parliament. However, President Sirisena has responded to the UNP’s charge by arguing that, under the amended constitution, he is permitted to appoint any prime minister who in his “opinion” is most likely to command confidence.

The UNP argues the President’s “opinion” is more than a matter of personal judgement, and should be based on whoever commands most parliamentary seats. Consequently, it called for an emergency vote of MPs to prove Mr Wickremesinghe still has majority support – a move that was forestalled by the President when, on 27th October, he suspended parliament until 16th November.

As a consequence of this, the 2019 Budget, which was due to be presented on 5th November, has now been postponed indefinitely.

As we write, Mr Wickremesinghe is still refusing to recognize his dismissal and continues to occupy Temple Trees, the prime minster’s official residence.

It is possible that the UNP will call upon the Supreme Court to rule on Mr Rajapaksa’s appointment.

Mr Rajapaksa, meanwhile, has announced he will occupy the prime minster’s office from 29th October and, from there, will proceed to appoint his cabinet. In a statement, he has called for a snap parliamentary election to “give the people the opportunity to vote for a programme to bring the country out of the encompassing economic, political and social crisis.”

He added, “Today our country is in a state of uncertainty. Details of a plot to assassinate the president and the former defence secretary have come to light. Those involved in this conspiracy are being exposed by their own actions.” This is a reference to a charge levied by the President that Mr Wickremesinghe has been obstructing an investigation into an assassination plot unveiled by a security agent in mid-September.

The upheaval could have international repercussions, as the rivals now claiming the premiership have the support of different international powers.

During the period in which he last served as prime minister (2005-15), Mr Rajapaksa – who faced criticism in the West over the manner in which he brought an end to the Sri Lankan civil war – forged ties with China, which extended loans for reconstruction and promoted large infrastructure projects such as the Hambantota port, the debt from which proved unsustainable, and over which China Merchants Holdings has now secured a majority interest in a 99-year lease. According to reports, China’s ambassador to Sri Lanka has congratulated Mr Rajapaksa on his re-appointment.

The US has called upon the President “to immediately reconvene parliament and allow the democratically elected representatives of the Sri Lankan people to fulfill their responsibility to affirm who will lead their government.”

India thus far has said only that it is following developments closely and that it hopes “democratic values and the constitutional process will be respected.” However, it was evidently concerned by China’s increased influence during Mr Rajapaksa’s previous term.

https://uk.reuters.com/article/uk-sri-lanka-politics/global-pressure-rises-on-sri-lanka-president-to-defuse-political-crisis-idUKKCN1N30JC

http://www.infolanka.com/news/

Economics – IMF concludes visit to Sri Lanka to discuss progress of Economic Reform Programme

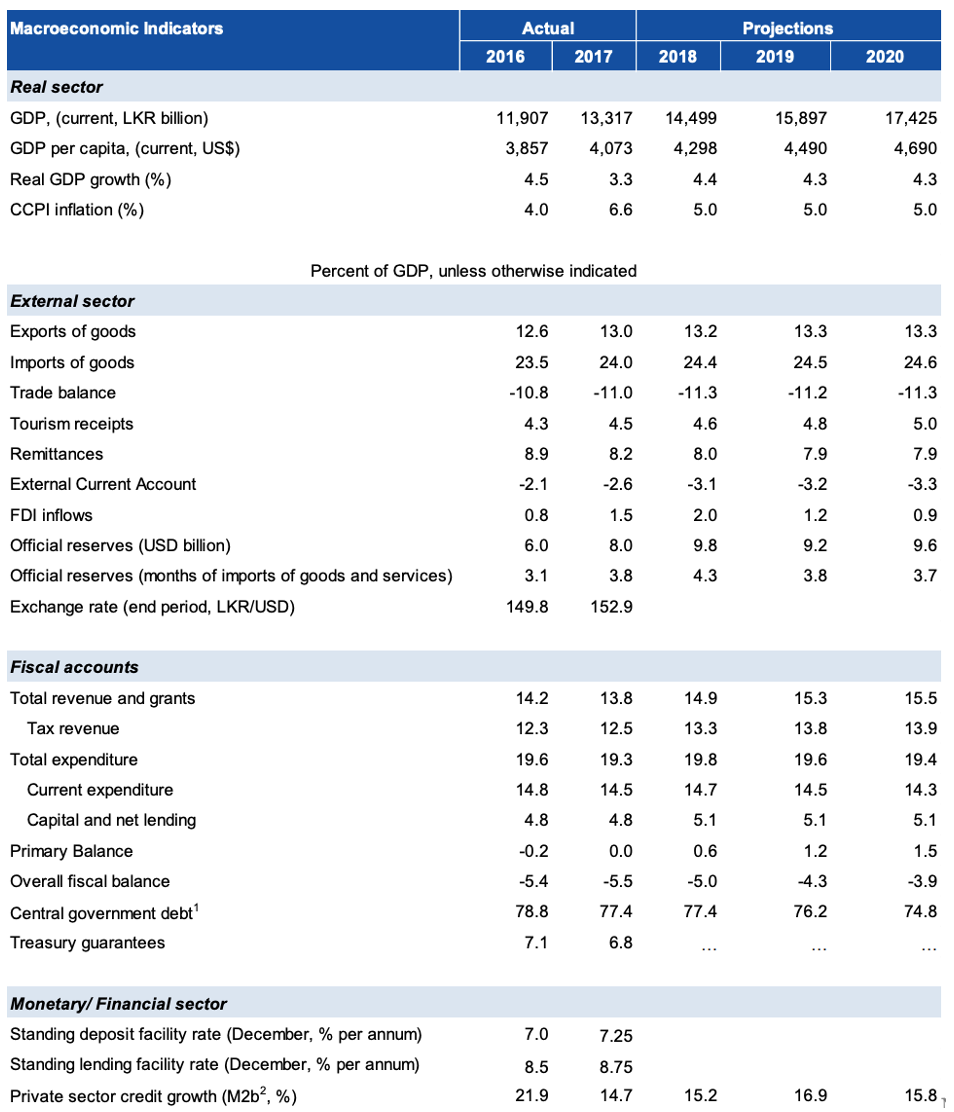

At the end of September, the IMF issued a preliminary statement on the economy following the completion of its mission’s most recent visit to Colombo. The highlights of the statement are as follows:

- Economic performance has been mixed in H1 2018, with growth recovering gradually and inflation stabilizing in the mid-single digits.

- Growth is projected to remain below 4% in 2018 and gradually to reach 5% over the medium term.

- The current account deficit has widened on the back of higher fuel imports, despite strong export performance, while international reserves have declined from their April peak

- With respect to reforms, the target on the primary surplus for end-June 2018 was met and inflation remained within the targeted band, but reserve accumulation and tax revenues fell short of plan due to the weaker economic environment and delays in policy implementation

- Reforms are needed to strengthen economic resilience, although the authorities have maintained a strong policy stance, with prudent monetary policy and further fiscal consolidation

- The commitment to amend the Central Bank’s Monetary Law Act, supporting the transition to inflation targeting and strengthening the CBSL’s governance and accountability, was welcomed.

- Renewed efforts to strengthen reserve accumulation and a clear commitment to exchange flexibility are critical to enhance external competitiveness

- Looking forward, the CBSL should be supported by a strong 2019 budget, a well-defined medium-term debt strategy and sound fiscal rules to secure debt on a downward sloping path

- With revenues falling short of target, the focus should be on implementing the Inland Revenue Act, supported by measures to strengthen tax compliance

- Structural reforms are needed to bring transparency, accountability and cost efficiency to large SOEs. In this regard, the mission approved the implementation of furl price reform and encouraged the implementation of an automatic pricing mechanism for electricity.

- The authorities should push ahead with Vision 2025 to support rapid and inclusive growth through efforts to promote trade openness and investment, fight corruption, enhance protection and encourage female labour force participation