Growth in private sector deposits halved in February 2023, to 7.5% YoY and, as a result, the loan-to-deposit ratio has risen to 142% (133% in February 2022). The weighted average interest rate on deposits in riel (6.7%) and dollars (5.5%) has risen by 1.2% and 1.6% over the last year. Lending rates have also risen, but by a lesser amount (1.1% and 0.7% respectively). Higher rates are expected to dampen investment and consumer spending with a lag.

Domestic Interest Rates (% per year)

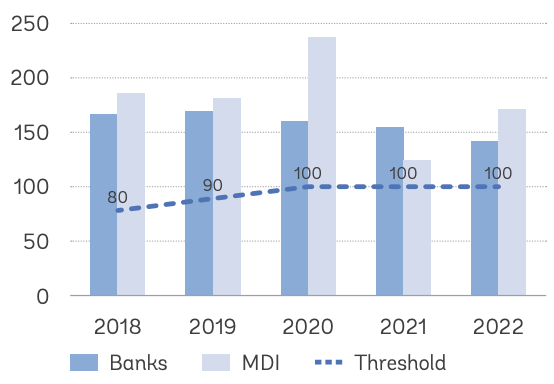

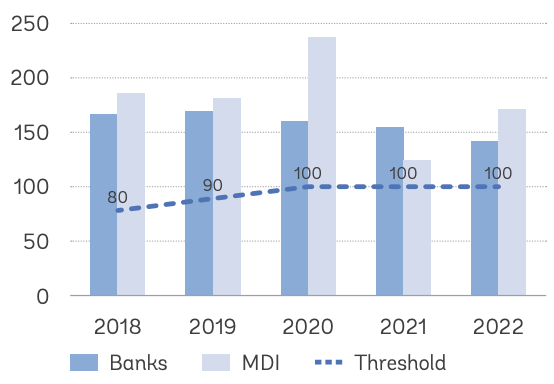

According to the National Bank of Cambodia, financial sector capital adequacy was 22.5% (banks) and 21.2% (microfinance) in 2022. This is above the 15% prudential threshold. Liquidity coverage ratios were 143% and 173% respectively.

At the end of 2022, reported NPL ratios were 3.2% (banks) and 2.6% (micro finance), although the Word Bank cautions this may not fully reflect declining asset quality, due to extensive loan restructuring, which was permitted during the pandemic. It says Cambodia’s high private debt raises concerns about the drag on the economy if borrowers struggle to meet repayments.

The World Bank believes intensified financial supervision is called for, as loan restructuring and forbearance is phased out. Measures suggested include stress testing individual institutions, onsite inspections, aligning the regulatory framework to international standards. In addition, the Bank proposes the authorities should continue with the preparation of legislation on deposit insurance and bank resolution. It believes the insolvency regime can be improved, and that data needs to be collected, so that activities in shadow banking, such as credit issued by construction or real estate developers to residential buyers, can be properly monitored.

Financial Sector Liquidity Coverage Ratios (%)

CURRENT ACCOUNT / FOREIGN EXCHANGE

In 2022, there was an acceleration in the growth of goods’ exports (to 22.5% YoY) and a slowing in merchandise imports, excluding gold (to 11.9% YoY). The drop in the oil price assisted. As a result, the current account deficit narrowed to 26.3% of GDP. The deficit continued to be largely covered by capital flows, especially FDI, and international reserves. The last represented 7 months of imports at the end of the year. The World Bank has indicated that it expects continued FDI flows and concessional financing largely to cover external financing needs.

Current Account (% GDP, excluding gold)

Whilst remaining largely stable against the US dollar, the riel has appreciated against the currencies of Cambodia’s major trading partners in the last year. Likely reflecting interventions to support the currency, Cambodia’s gross FX reserves have declined from $20.2bn at the end of 2021, to $17.7bn, at the end of February 2023.

Riel-US Dollar, Riel-Yuan Exchange Rates

FISCAL BALANCE

In 2022, government domestic revenue (excluding grants) rose by 22% YoY to 22.5% of GDP. There have been strong efforts to improve collections, with better tax administration, modernisation and the introduction of e-filing, e-payment, and taxpayer services. There has been a reduction in loopholes and increased harmonisation to prevent fiscal evasion, transfer pricing abuses and double taxation.

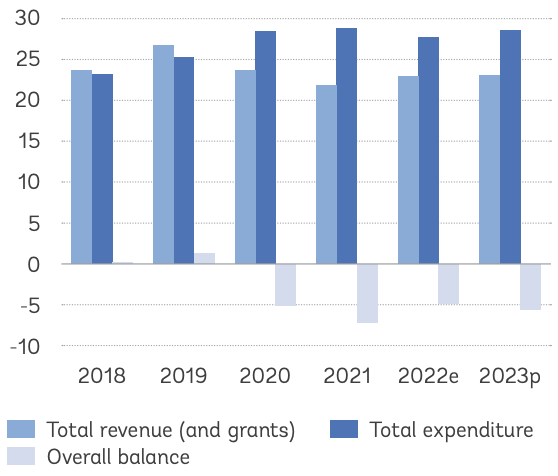

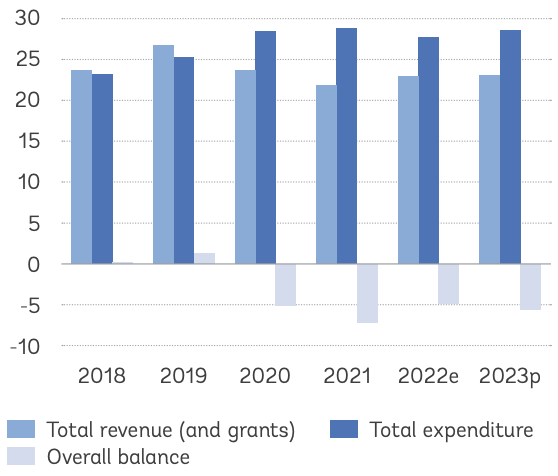

General Government Deficit (% GDP)

Government expenditure is expected to have declined to 27.9% of GDP in 2022, as expenditure on goods and services and capital spending moderated, and some pandemic-induced spending was phased out. The fiscal deficit is expected to have narrowed to 4.7% GDP.

90% of the deficit was financed by external funds, and 10% from the drawdown of government deposits, which stood at 17.8% GDP at the end of 2022 (23.6% at end 2020). The authorities have continued to follow the borrowing principle of only contracting external debt on concessional terms, until 2022, when domestic government securities were introduced. This has helped Cambodia to maintain a low risk of debt distress rating from World Bank and IMF.

General Government Surplus/Deficit and Financing (% GDP)

By end 2022, Cambodia’s public debt/GDP ratio stood at 33.7% (28.1% in 2019). Of the outstanding $9.98bn of debt, just 0.2% was public domestic debt. External borrowing remains highly concessional, with a weighted grant element representing 45% of the total, the weighted average interest rate being 1.1%/year and the weighted average maturity being 26.7 years. Of the loans contracted in 2022, 69% financed public infrastructure in areas such as transport, energy and water, and 31% non-infrastructure areas such as health, education and agriculture.

Public Debt Stock, Newly Signed Loans, Loan Disbursements

OUTLOOK

Real GDP growth is expected to accelerate to 5.5% YoY in 2023. Despite an easing in goods’ exports, the current account deficit is expected to decline to 19.3% GDP, with increased tourism receipts and remittances. Despite a recent decline in approved FDI projects, capital flows and concessional funding will continue largely to cover external financing needs.

The fiscal deficit is expected to widen to 6.4% GDP. Revenue mobilisation should remain strong, but expenditure will increase with rising post-pandemic operating expenses, an across-the-board increase in public sector wages, general election-related spending , and the cost of hosting of the SE Asian Games.

Over the medium term, real GDP growth is forecast to return to a trend rate of 6%, bolstered by newly ratified trade agreements, investments in key infrastructure such as ports and roads, and structural reforms.

Cambodia’s Economy – World Bank Staff Estimates and Projections

Risks are thought to lie to the downside. Key risks include weaker external demand, which could affect Cambodia’s export-oriented manufacturing (c.40% of industrial employment, 17% of non-farm employment), and global financial tightening, which could affect the highly leveraged financial sector. Concentration of domestic credit in construction is a key risk to financial stability.

SPECIAL FEATURE SECTION

Tax revenue/GDP is high by regional standards, and this has given Cambodia a relatively large fiscal reserve (23.7% GDP at end 2020).

Tax Revenue 2019-2020 (% GDP)

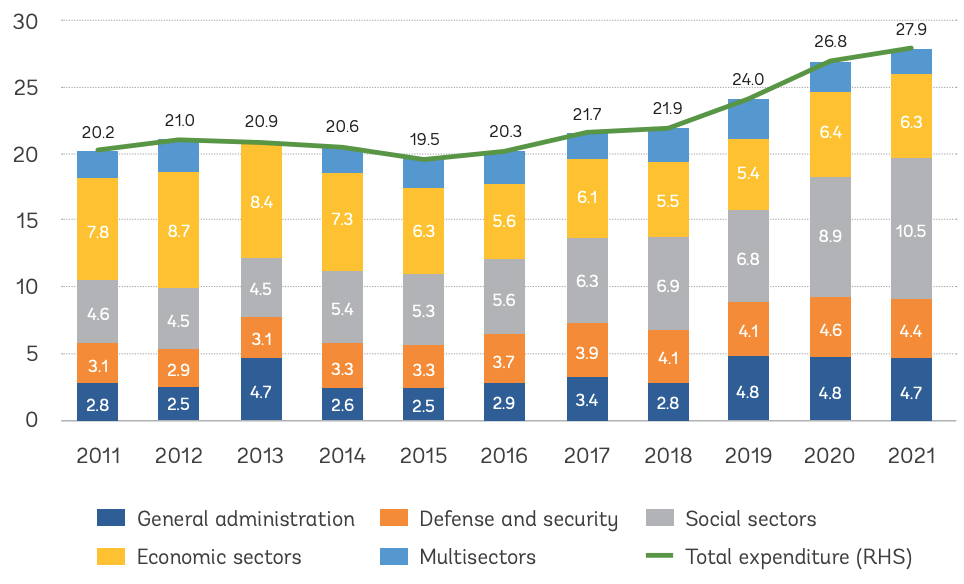

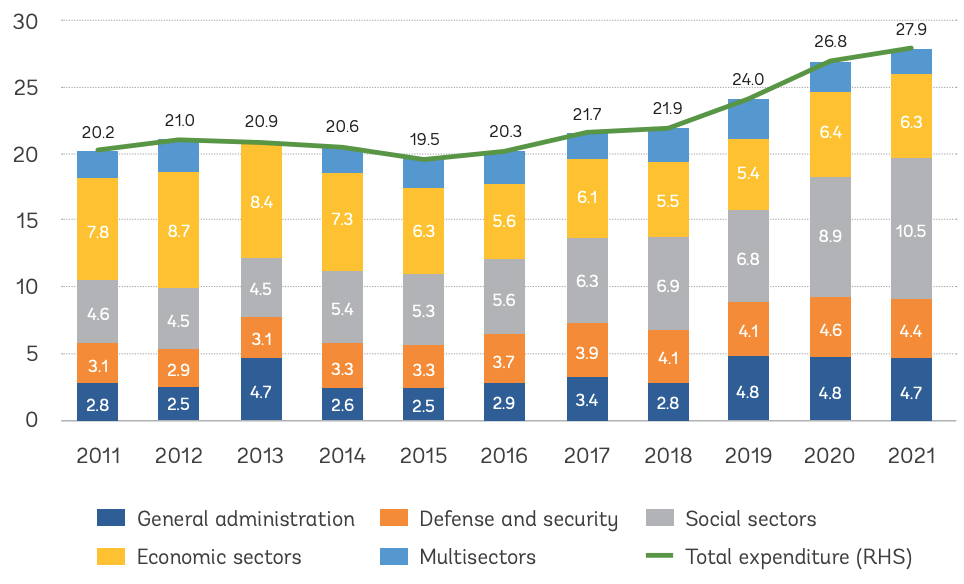

As a result, the government has been able to increase spending on healthcare and education, from 4.6% GDP in 2011 to 10.5% GDP in 2021.

Government Spending by Sector Grouping 2011-2021 (% GDP)

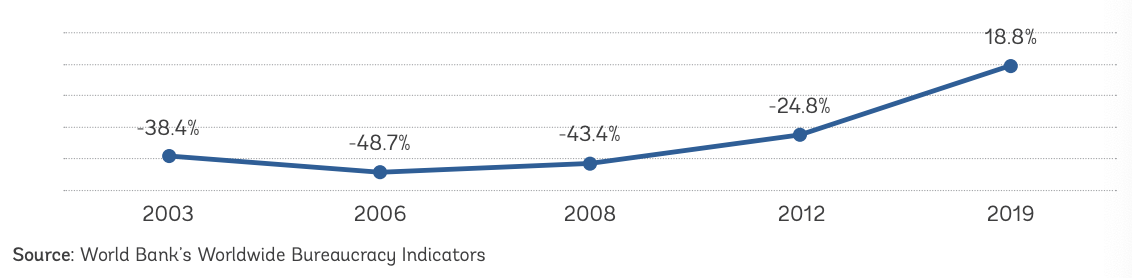

However, a good proportion of the increase has been represented by salary increases. As a result, the average public sector wage now exceeds the average private sector wage.

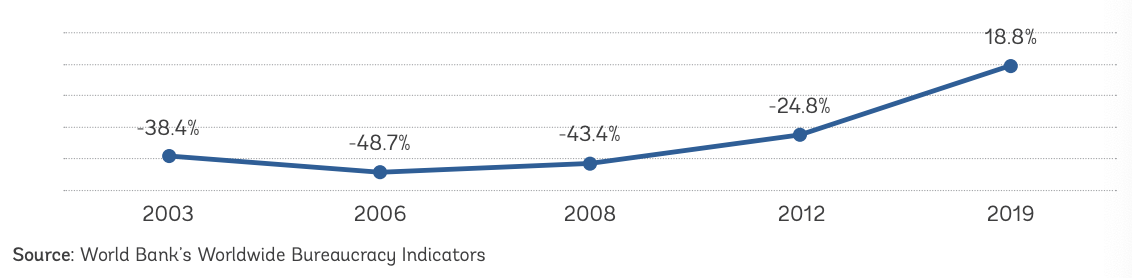

Cambodia’s Public Sector Wage Premium (2003-2019)

The World Bank has noticed that increased education spending has yet to translate into better learning outcomes. Capital spending has declined from 13% of education spending in 2018 to 3% in 2021 and, whilst the number of teachers is adequate overall, class sizes are larger than for Cambodia’s ASEAN peers, and the distribution of teachers is uneven, with pre-schools and primary schools experiencing shortages. Enrolment rates are significantly lower in rural than in urban areas.

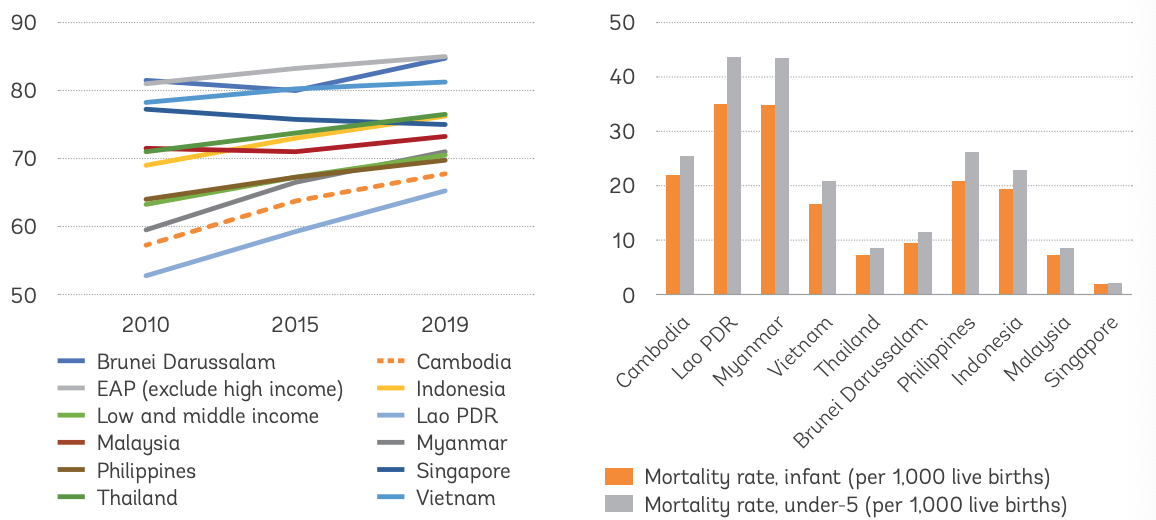

Comparison of ASEAN Countries’ Literacy Rates

Public health policy effectiveness is limited by low public health spending, low utilisation of public health facilities (reflecting perceptions of their quality) and high levels of out-of-pocket spending ($115pa per capita). This means the poor are more vulnerable to income shocks and are less likely to have access to health services. Spending on administration (35%) is high and spending on health service delivery, especially preventive care (4%), is low by regional standards.

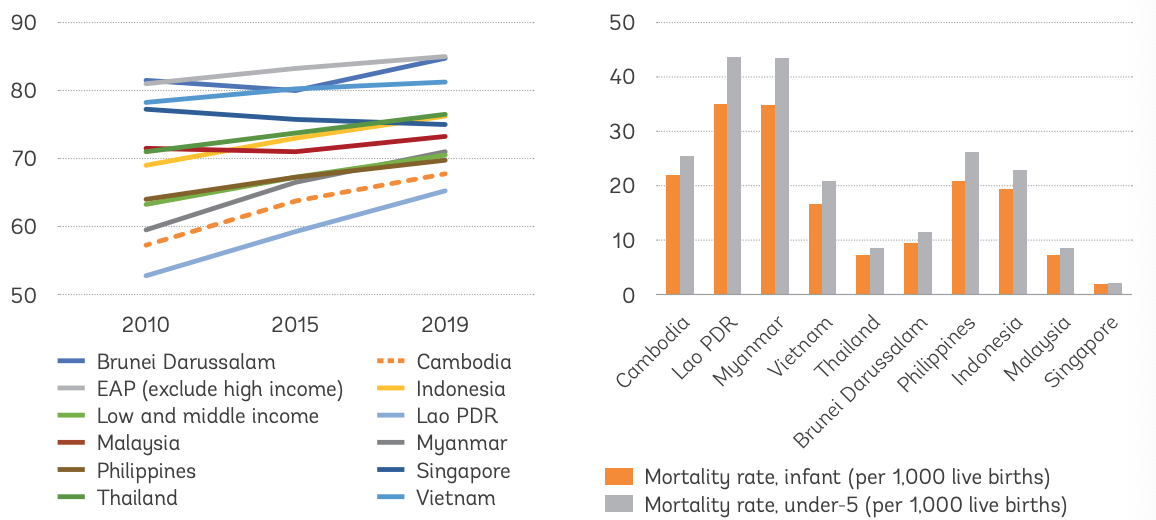

As a result, life expectancy is low and infant mortality is high, by regional standards.

Regional Comparisons of Life Expectancy (LHS), Child Mortality (RHS)

The World Bank believes the quality of spending in these areas needs improvement. To enhance spending outcomes, it favours the introduction of performance-based management and accountability mechanisms in education. In healthcare, it sees a need for an allocation of greater resources towards the number of health professionals, to diagnostics and treatment, and to investments in health infrastructure, technology, and information systems.

For full details of the World Bank’s report, please use the following link to its website:

https://www.worldbank.org/en/country/cambodia

The following link may be used to access the IMF’s research on Cambodia:

https://www.imf.org/en/Countries/KHM